Kristen LaFrance is the Growth Lead at Churn Buster. She is dedicated to educating companies and founders on the importance of customer retention and the dangers of ignoring churn of all types.

Kristen LaFrance is the Growth Lead at Churn Buster. She is dedicated to educating companies and founders on the importance of customer retention and the dangers of ignoring churn of all types.

Thanks to Kristen and the Churn Buster team for sharing these common churn causes and helpful avoidance techniques.

So you’re focused on improving customer retention, trying to do everything in your power to reduce churn. That’s awesome! But maybe your efforts are falling short and churn prevention is starting to feel a bit overwhelming and disheartening.

This is actually extremely common. Churn is tricky. You’re dealing with human beings who have different needs, different communication styles, and different decision-making processes.

So even if you’re working as hard as possible to keep those hard-earned customers, it can be a long and arduous road to retention. If you feel like you’re doing your best to reduce churn, but you’re not seeing the results you expected, you may be missing the mark on some sneakier churn drivers.

Let’s look at some of these lesser-known reasons you may be losing customers.

1. You’re marketing to the wrong people

New customers are exciting, I can level with you on that. This excitement makes it tempting to think any new customer is a customer worth celebrating, but that’s not always true.

There will be leads that come into your pipeline who simply aren’t a good fit for your product.

Maybe their needs don’t match your offering perfectly or the tech is too advanced. Maybe you don’t actually offer what they thought you did. There are endless reasons for a bad fit between product and customer, so don’t get too hung up here.

It’s important to remember that bad-fit leads will eventually churn out no matter how incredible your product is. These users are simply finding a mismatch between their needs and your service. Don’t take it personally, they’re just not meant to be on your platform (and if you’re putting the customers’ needs above your own, you will be okay turning away people you can’t serve well).

Even in the early stages of growth, converting bad-fit leads into paying customers can actually cost you more in the long run. When your product simply isn’t the solution they need, they will drain your support team and pull your resources and attention away from more valuable customers.

So how do you spot a bad-fit lead before they become a customer? First, make sure you understand who the best-fit customer is and make detailed buyer personas.

What are the characteristics of your most successful customers? How did they find you? What were their specific pain points? How does your product solve them? What is their role in the company? Were they the decision maker? If not, who was?

Next, figure out what a bad-fit customer looks like so that your marketing and sales team can spot them before they convert. Create buyer personas for poor-fit leads as well and ensure everyone is educated on who you want to hold at the door.

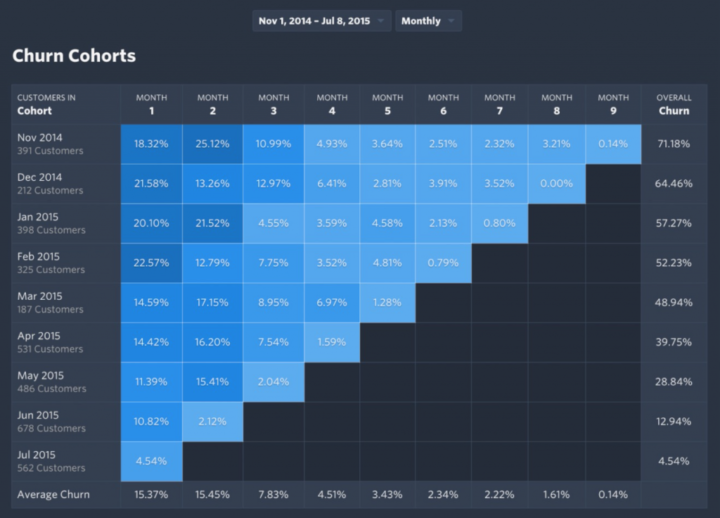

If you’re unsure if this is a problem for you, analyze your churn in monthly cohorts. If you’re seeing high levels of churn early in the user journey, take a closer look at who you’re marketing to and how their needs line up with your offering.

Ensuring you’re bringing in the best-fit customers will set you up for dependable growth built to last.

2. You’re focused too heavily on new customers

This ties in really well with the previous point. Yes, acquisition is absolutely vital to continuous growth. You need to be bringing in new users as often as possible. But, if you can’t keep those customers long-term, you’re just running in place.

Retention is the bedrock of any successful SaaS business. You need a stable use base with compounding growth instead of a shaky one that’s constantly churning and burning through customers.

If you’re fighting nonstop to bring in new customers, but not focusing on your existing customers, your churn battle is going to be never-ending.

Think of it this way: When you build a platform that users stick with and continue to pay for, in turn, you increase your funds and resources available to market to new customers. So for sustainable growth, retention is just as vital (if not more vital) than acquisition.

So what do you do? Invest in your customers more than you invest in your leads. Systematize customer success so that every team member is focused on creating the best experience for your current user base.

Here are a few quick tips to help you focus efforts on existing customers:

- Proactively engage with your users as often as possible

- Map out the user journey and create engagement strategies throughout

- Ensure your product roadmap reflects the needs of your current users

- Build an internal system for implementing and analyzing retention efforts

- Foster empathy for your users (treat them like humans, not numbers on a screen).

If you’re surprised how many customers you’re losing, despite working hard to create the best product possible, look at who you’re serving most.

3. You’re not tracking and measuring engagement

You’re working hard to focus on existing customers and improve their experience, but you’re still not sure why customers are leaving. While your intentions are correct, maybe you’re falling short on how you track and measure those intentions.

This is what can make customer retention feel a lot like damage control. A little more like you’re running around trying to make as many last minute saves as possible rather than proactively preventing churn.

Sound familiar? It doesn’t have to be this hectic.

Start by looking at customer retention as a way to dig in and connect with your customers. It’s not about saving people wanting to cancel, it’s about engaging with customers so they never consider leaving in the first place.

There are tons of ways to improve engagement within your user base and you should be constantly testing new ways to connect with them. Hint: this should actually be really fun! You essentially want your customers to be integrated fully with your product, team, AND your brand.

So engagement is important, you probably already knew that. Then why are you still losing customers? Likely because you’re not thoroughly tracking and analyzing engagement.

Just like any marketing tactic, your engagement tactics should be tracked and measured.

How much did adding an automated live chat on day 5 improve engagement with new users? Did a blog post sent to your customers result in more in-app activity that week? Does an in-app feature announcement lead to more users checking it out?

It’s important to have systems set up to track when customers are logging in and how they are interacting with your platform. Intercom, MixPanel, and Heap are great options for this.

Although engagement is all about human interaction, data should still drive the majority of your decisions. It goes without saying, but the more active your customers are, the more likely they are to stay.

4. You’ve prioritized upgrades over value

Subscription-based billing and customer upgrades go hand in hand. When you have multiple pricing tiers, you’re constantly looking for ways to naturally upgrade customers to extend their LTV and increase your revenue.

But, if your pricing tiers are designed around upsell opportunities and you’re pushing those too aggressively, you may be doing more harm than good.

You know the importance of retention. That’s why you’re reading this article. But if you’re prioritizing upgrades over value provided, you’re not actually working towards retention and you’re likely missing the mark for your customers.

Pricing tiers need to be designed to provide value, not to encourage upsells. The most successful and happy customer is one with all of the features they need, without a lot of excess.

Each customer should be on the plan that provides them exactly what they need, no more no less. If you’re cutting features at the knees on your lower plans just to push people up the ladder, you will really start to upset customers.

Conversely, if you’re putting customers on plans that provide more power than they actually need, they may fall into the analysis paralysis trap.

Think of it this way: How often do you return to the same coffee shop simply because it’s easier than combing through all of the options on Google?

When customers have more features and options than they truly need, they will start to wonder if they’re really getting their money’s worth. And once they start questioning your value, you’re already behind.

So take a look at your pricing strategy and upgrade initiatives. Are you pushing customers up who don’t truly need new features? Are your lower-tier plans simply built to get people in the door rather than provide real value for those beginning customers?

Being on the right plan gives users the best experience possible. Focus on the value provided for each customer and you’ll plug this sneaky retention leak. And as an added bonus, as customers become more comfortable and successful on their plan, upsells will begin to happen more naturally. It’s a win-win.

5. You’re failing to address passive churn

Passive churn is hands down the sneakiest revenue leak out there, because customers can simply slip away without you noticing. And if that sounds a bit scary to you, good. Passive churn is often one of the most overlooked leaks despite being one of the easiest to plug.

Passive churn occurs when failed payment issues aren’t resolved with your customers. You may already be thinking this can’t be that big of an issue. Hold that thought. Founders simply don’t understand the compounding nature of churn and how a small improvement can create huge returns in cash flow.

It’s common for about 40% of churn to be caused by payment failures. That’s 40% of churn that didn’t need to happen. 40% of churn that could have been recovered. And 40% of churn that’s happening passively, despite your best intentions.

So without a reliable dunning system in-place to handle failed payments and recover that revenue, your churn will quickly accelerate leading to compounding revenue loss, poor user experience, and an overwhelmed support team.

From flexible campaigns to trustworthy emails and seamless card updating, there are lots of ways to optimize your failed payment recovery campaigns and delight your customers in the process. Here’s a great guide to creating a leak-proof dunning system and a handy cheat sheet for failed payments.

So what can you do about this leak? Get the right tools for fighting passive churn.

Chart Mogul is great for measuring and tracking churn over-time and gaining a deeper insight into your performance. Churn Buster is solely focused on failed payment recovery and can help you create an optimized system with full control and transparency. With these two best-of-breed tools in your arsenal, you’ll quickly plug this sneaky leak so you can move onto the fun stuff.

You CAN beat your churn

If you’re still reading, it’s safe to assume you’ve felt a little bogged down by your retention efforts. But don’t fret. You’re on the right path, you just have to start looking at the quiet, lesser-known churn drivers too. The little instances where your engagement and customer relationships aren’t diving deep enough.

And now that you’re looking deeper into retention, you can start to strategically test and analyze new ways to better serve your customers.

No matter how amazing your product is, there will always be a user who hasn’t had the greatest experience or a user who simply doesn’t find the value in your product. That’s okay. As long as you are constantly creating a customer-centric culture where serving your customers first is your biggest focus, you’ll surely create a more stable customer base ready to grow and scale with you.

Churn is tricky but you can beat it. I promise.