In September, Christoph Janz and Nick Franklin shared nuggets of their collective wisdom on the SaaStock stage. We’ve gathered it here to share with those of you couldn’t make it to Dublin.

1. Don’t give away your product too cheaply.

Align your price with value. Increase your prices. You don’t have much to lose.

Worried about your pricing and how to proceed with changing it? Take a look at “What to do when your SaaS pricing is wrong.”

2. Don’t assume your growth rate will stay steady.

Just because you’re growing at >20% MoM in your first year, don’t assume you can do the same in your second year. The climb gets steeper.

Think about it in terms of raw MRR growth you need to attain that 20% growth rate over time. The amount of new revenue needed to sustain it increases incrementally as your business grows, to the point that it might become extremely hard to add that much new MRR each month.

Instead, when evaluating your growth, base it on Net MRR %. This takes into account churn and contraction business, which gives you a more accurate picture.

3. Don’t reinvent the wheel!

Leverage the knowledge that is already out there. There’s a wealth of best-practice information available online. Case in point: Jason Lemkin on Quora.

Study the needs of the market as well as the products that already exist.

4. Don’t mistake latent demand for Product-Market Fit.

Or as Peter Reinhardt, CEO of Segment, put it in his SaaStock speech:

“Glimmers of false hope are not the same as customers wanting to rip it out of your hands.”

Understand the market dynamics. Example of a failed product: Segway.

Read up on common (tangible) indicators toward Product-Market Fit.

5. Don’t screw up your fundraising.

Aspire to create an awesome slide deck, not just okay. Talk to the right number of investors so that you create a competitive process. This increases your leverage.

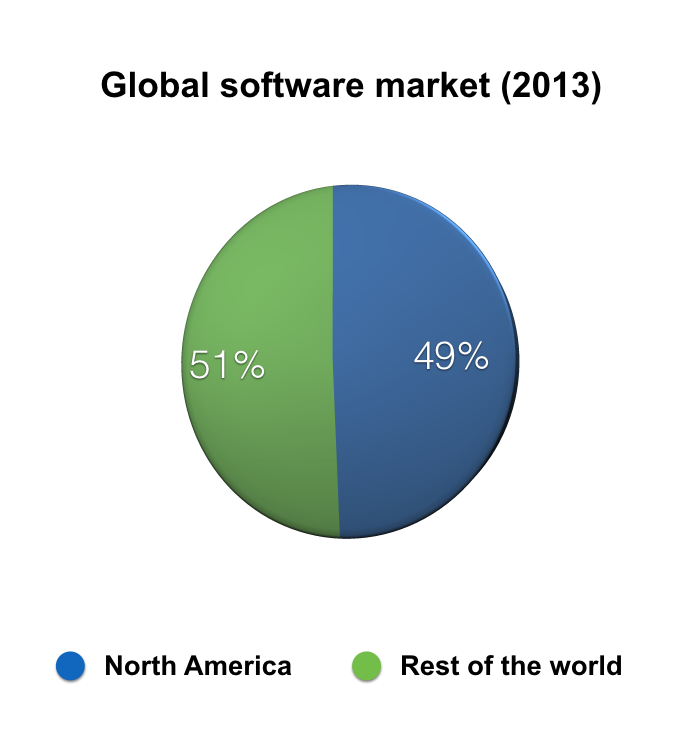

6. Do everything you can to win the US market.

Even if it means neglecting your home market.

You want to be a category leader. It comes with innumerable subsequent benefits to the business. For example, as a category leader your company already has some brand recognition, so your sales and marketing efficiency is much higher.

And to be a category-leading SaaS business, you need to be competitive in the US. If you win North America, you win globally.

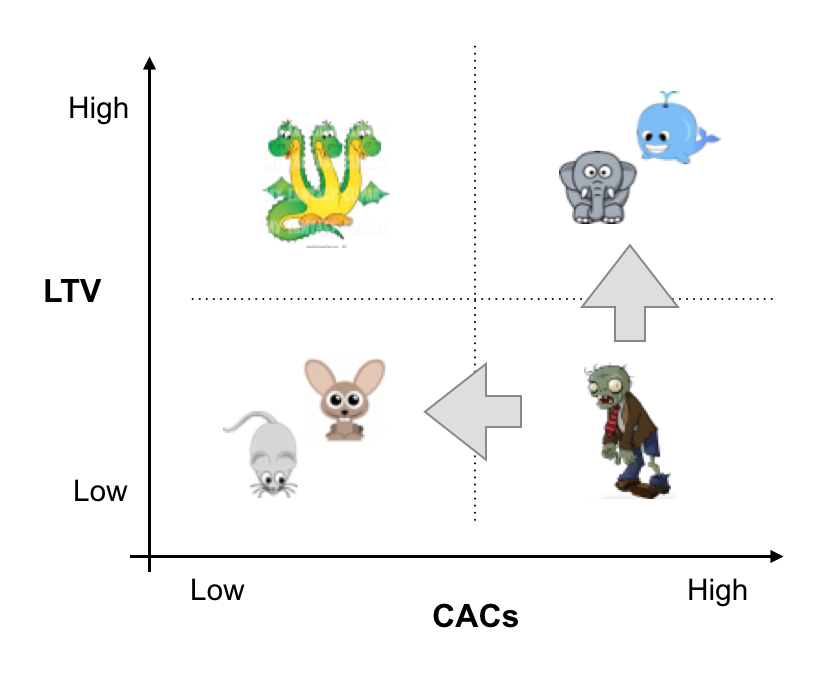

7. Don’t end up in the SaaS graveyard of low LTV and high CAC.

Stay vigilant about reducing CAC and increasing LTV. In the image above, you want to be moving up or left, ideally both.

How important is it? Well, if you cannot monetize your customers, then none of your other hard work matters. David Skok remarks looking at a group of failed startups:

“…A very large number of these had solved the product/market fit problem, but still failed because they had not found a way to acquire customers at a low enough cost.”

Many sources cite an ideal CAC:LTV ratio of 1:3. For further reading, Ed Shelley evaluates the most effective method for measuring the CAC:LTV ratio. (Hint: segmentation is key!) And for more information on LTV as a metric, check out this Customer LTV Cheat Sheet.

8. Don’t blow your seed round on paid advertising. Do invest in engineering and a world-class product.

This is how you get to Product-Market Fit. This is how you become a category leader.