A quick side-story

I’ve been going to the same barber for the last 3 years that I’ve lived in Berlin. Over that time, it’s grown in popularity at a surprising rate (unicorn growth?!), to the extent that I now have to go at the most off-peak times possible to avoid queues. From what I can see, the place excels at friendly, good service, offering a better-than-average haircut at rates that undercut most of the competition. No-brainer!

But last month, something surprised me. They’ve opened a second salon on the same street, just a few doors down from the original. Except with this place, it’s all decorated in black (not too uncommon for Berlin), with chic black and white model photos hanging on the wall and high-end furniture instead of plastic chairs.

So what happened here? It looks like they saw great success in the lower-end segment of the hair salon market. But clearly there’s only so much money to be made on “commodity” hair cuts at €15(!), even at the volume they’re doing. So, they did what many businesses do — they moved up-market.

What it really means

Okay, so SaaS is a world away from retail and hair salon businesses, but the concept of moving up-market remains the same.

Many SaaS businesses start out targeting the SMB segment of a market, for a number of reasons:

- Their product is immature and light on features, probably solving a highly targeted use case or problem.

- They’re probably pricing themselves low to reflect the lack of product maturity.

- SMBs are much more willing to be early adopters and beta testers.

- Self-service signup and onboarding requires little to no sales team and suits inbound Marketing techniques.

Moving up-market, in this scenario, means shifting the focus of the product and business to target a larger-sized customer (what might be referred to as more “Enterprise” customers).

What’s the big attraction?

Many of the acquisition channels that can be so effective in the early stages of a SaaS business (word-of-mouth, Content Marketing etc.) will often fizzle out — or at least lose some momentum — when the business reaches a certain size. The reality is that you’ve tackled the “early adopter” part of the market, or a lot of the low-hanging fruit customers that are relatively easy to attract and onboard in your product.

Moving up-market is often seen as the answer to the problem of early acquisition strategies failing as they reach a certain scale. Growth targets can start to look like a vertical wall when trying to maintain a constant growth rate past the early stage. As a result, customer acquisition costs can sky-rocket, or simply lose their effectiveness.

Check out this related read: The Grapevine of B2B: how word of mouth actually works

The Enterprise grass is always greener

At a first glance, repositioning to sell to larger Enterprise-level business can seem like a win-win strategy. Here are some positives:

- Far greater profit margin on large deals

- Economies of scale: Much smaller support and customer success overhead to service fewer accounts

- More focused Sales effort, and less reps required to service the same amount of ARR

- Willingness to spend: Selling to businesses who already have a budget signed off for your product category

- Greater stability: Selling to established businesses. If you’re targeting SMBs, some of those companies will inevitably go out of business or pivot, and cancel their subscriptions.

Who has successfully done it?

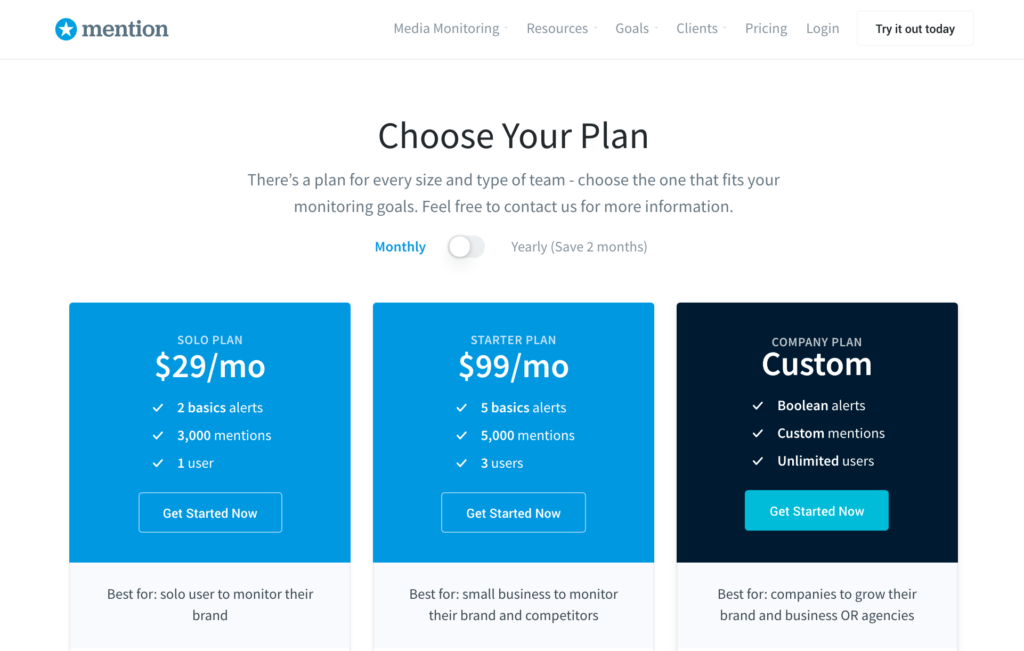

Mention

Mention, the Paris-based brand monitoring tool, started out as product for “prosumer” users. That is to say, it was targeted towards individuals (rather than businesses) with a Freemium pricing model. This model obviously relied on driving a large volume of new users to the free plan and eventually expanding them onto a paid plan. The company did manage to drive a lot of signups in the first couple of years, thanks to a referral program and other incentives for users to create a free account.

In a recent interview with Groove, co-founder and CEO Matthieu Vaxelaire explained how things went early-on:

“It went very well in the beginning with free users, but then we started to see some very big companies sign up. Companies on the level of Facebook, Microsoft, Spotify, that size. And we realized, ‘Oh my god, we’re leaving money on the table.’”

~ Matthieu Vaxelaire, CEO of Mention

Re-positioning for enterprise customers is a common temptation when you see larger, more recognisable brands signing up for your product. It’s worth actually testing that demand though, before jumping into a company-wide pivot towards enterprise.

As Matthieu explains, implementing the changes to the business definitely caused some pain – changing people’s perception of your product is far from an overnight switch — and by pushing up the price, you’re asking people to adopt a drastically different way of approaching your solution. For some people, that inevitably means accepting that it’s no longer a viable product for them. And that’s fine.

“Of course, there was some legacy perception in the market; in people’s minds, Mention was a free product, and it was for prosumers. For some of those people, it was difficult to jump on the new pricing structure, but as we shifted our positioning to targeting the B2B market, it became less and less of a problem.”

~ Matthieu Vaxelaire, CEO of Mention.

Source: https://www.groovehq.com/blog/matthieu-vaxelaire-mention-interview

Dropbox

Dropbox launched in 2008 and very quickly became a dominant player in the consumer cloud storage market. Towards the end of 2012, the service had already amassed 100 Million users, thanks to an aggressive growth strategy involving a widely-publicised referral scheme. By referring other users to sign up, the referrer could earn additional storage space in their own account for life. In fact, the reason why I’m still able to use Dropbox for free today is because I managed to refer so many friends back when the service was relatively new, so I have a greatly-increased storage limit.

I’m sure you can see the problem for Dropbox here — in the years since 2008, cloud storage pricing has seen a race to the bottom. Nowadays many of the larger platform providers offer gigabytes of space for mere cents, or even for free. These are conditions in which a company relying on revenue from storage services cannot survive. Dropbox needed to move up-market.

In the years since, it’s fairly clear where Dropbox’s priorities lie. They’ve introduced:

- A re-launch of Dropbox Teams as Dropbox Business

- A host of security partnerships with companies like Symantec

- Single sign-on (SSO) for business accounts

- Tighter admin controls for business accounts

- A set of business APIs

- Integration with Microsoft Active Directory for large-scale rollout across companies

- A set of advanced security certifications

It’s 100% clear from this that Dropbox is pushing hard into the Enterprise space, to compete with the likes of Microsoft, Google and Box.

Will they succeed? The jury is still out on that one. They’re definitely seeing growth in that part of the market, more recently announcing 200,000 business accounts compared to the 50,000 at the beginning of 2012.

Some dangers and risks

> A move up-market is not far off a complete pivot; don’t underestimate the change required.

When you’re at that “magic” $1M ARR and struggling to scale your existing acquisition channels and processes, it’s incredibly easy to ignore the risks of a move towards the Enterprise space. You probably have a small handful of customers at that large size, and the vision of a customer base comprised solely of large businesses seems like a dream.

Jason Lemkin of SaaStr gives some very cautious advice to those companies considering the move:

“If SMBs are your core, stay there, at least until $10m ARR. Do not chase customer segments where you have zero, or only token, traction. Not at $1m. It’s “too late”. You’ve already established your initial, organic customer traction and segmentation.”

~ Jason Lemkin, Founder of SaaStr & VC

(Source: https://www.saastr.com/how-do-you-get-from-1m-arr-to-10m-arr/)

This may seem drastic, but he has a point here: If you reach $1M, you’ve probably spent the last couple of years grinding like crazy to get some traction selling to SMBs. Things have just started to work. You’ve bedded in a lot of the aspects of the product, marketing and sales that make selling to SMBs work. At this point, switching to target the enterprise segment means throwing a lot of your progress and recent success away. Adopting a fresh strategy at such a critical stage of the business could be fatal in the long run.

The “Moving up-market checklist”

Here’s a high level view of what will need to change in a SaaS business

Product

Enterprise customers carry high expectations about features — you’ll need to be prepared for bespoke features or integrations for specific clients. On top of this, be prepared to re-shuffle your roadmap to prioritize those Enterprise features, and jump through hoops such as certification and compliance for different standards.

Here are some typical Enterprise-focused features you may need to build:

- Secure authentication

- Single Sign-On (SSO)

- Integration with existing Enterprise software

- Advanced user management & permissions

- Advanced reporting & event logs

But not all Enterprise features require you to write code…

- Unlimited usage / transactions

- Premium support (24/7 phone support, etc.)

- On-site training

- Guaranteed uptime SLA

- Security standards compliance

Difficulty rating: ⭐️⭐️⭐️⭐️⭐️

Product marketing

You’ll need to change the focus of Product Marketing to target the core value of your product, as understood by the enterprise audience. Additionally, the channels to reach this audience are likely to differ from those you’re using to reach your SMBs.

Difficulty rating: ⭐️⭐️⭐️⭐️

Content marketing

Attracting Enterprise leads with traditional inbound content can be tough. Larger enterprise businesses are not accustomed to self-signup models, particularly when large contracts are at stake. It’s definitely possible to generate well-qualified inbound leads through well-targeted content, but you may need to pivot the Content team to focus more on materials that support the Sales team’s increased efforts.

Difficulty rating: ⭐️⭐️⭐️

Sales

Sales processes need restructuring to accommodate a much longer sales cycle. Additional training may be required to nurture high-value leads, with dedicated reps working for long periods to seek out the right stakeholders and work with them through to closing.

Difficulty rating: ⭐️⭐️⭐️⭐️

Customer Success

Expect to offer higher-touch support, particularly onboarding, when working with Enterprise customers. They’re paying a premium so they’ll want things to simply “get done”. Customer Success may also need to take on some of the bespoke integration work that can’t feasibly be done by Product & Engineering.

Difficulty rating: ⭐️⭐️⭐️⭐️

Company culture & Hiring

Last (but definitely not least), you should consider what needs to change in the culture and DNA of your company. This includes everything from hiring (do you need execs with proven experience in Enterprise?) to the company’s vision and attitude towards everyday work. This is perhaps the hardest thing of all to change, and at the same time, the most important. The risk of not having the whole company aligned behind your mission is too great to leave alone.

Note: This extends to your customers too. If they start to see you as a ‘sell-out’, or feel neglected and cast aside from your change of focus, don’t expect them to keep quiet for long!

Difficulty rating: ⭐️⭐️⭐️⭐️⭐️

The bottom line

As you may have noticed, nothing listed above is easy. The decision to move up-market and re-position your product for Enterprise customers is one that should not be taken lightly: Treat it as a full-scale pivot of the business. Start with “core” of your business – the people and culture – and foster change from the inside out, with everyone aligned and onboard.

If you can survive and come out the other side without fatal injury, there are great rewards to be reaped. Good luck!