“I never saw this coming.”

Famous words of a broken heart. You’ve heard them before in a movie or a song, read them in a book. Maybe you’ve said them outloud yourself before? (Sorry to bring up bad memories…)

But it’s one of the most common disappointments in the world — to wish you had seen the signs that something was headed off track, and to have had the chance to right its course before it was too late.

And in the context of your own company, where your product is your baby and every customer is hard-won… every time someone cancels, doesn’t it feel like a tiny heartbreak? Doesn’t a little voice somewhere say, “I wish we’d have known” or “what could we have done”?

Well, in the world of SaaS, there are ways to avoid all that, or at least to lessen it, the heartache of churn. Using data from your app and clues from customer behavior, you can learn to spot cancellations before they even come fully into view. And the beauty is that once you spot them, you can stop them.

Let’s talk about how.

(Need a refresher on customer churn rate? Check out our Actionable Metric guide. Curious how to measure it for your business? Read how we break it down for B2B vs B2C.)

What are you looking for?

Red flags. Signs that a customer is disengaging. If you monitor your customers’ activity in your app and interactions with your team, there are quite a few indicators that they might be drifting away from your product.

- A customer isn’t logging in, or is logging in less frequently.

- A customer hasn’t completed onboarding.

- A customer isn’t using key features.

- A customer stops contacting Support.

- A customer has routine payment problems (consecutive late payments or service suspensions).

- A customer has recently submitted an NPS of 6 or lower.

There are a couple of things that may happen on your customer’s end, in-house, which you could note, too.

- A customer’s point-of-contact changes.

- Business or economic changes within the customer: company pivots, new market segments, and new funding rounds could all lead to a shift in needs.

(These are hard to track at scale, but could be worth it for high-value accounts.)

How can you keep track of the red flags?

You can manage churn prediction on your own, if you’d like.

- Maintain your own log files of app usage data. Build a model that recognizes patterns — in timing, in activity, in timing of activity — and which you can review to identify the customers that might be headed to the brink.

- If you have a customer success team, have agents make notes in whatever CRM you use.

Otherwise, there are a host of tools that will do this for you. Many of them are designed to help you predict churn and will run reports that make customer monitoring easy.

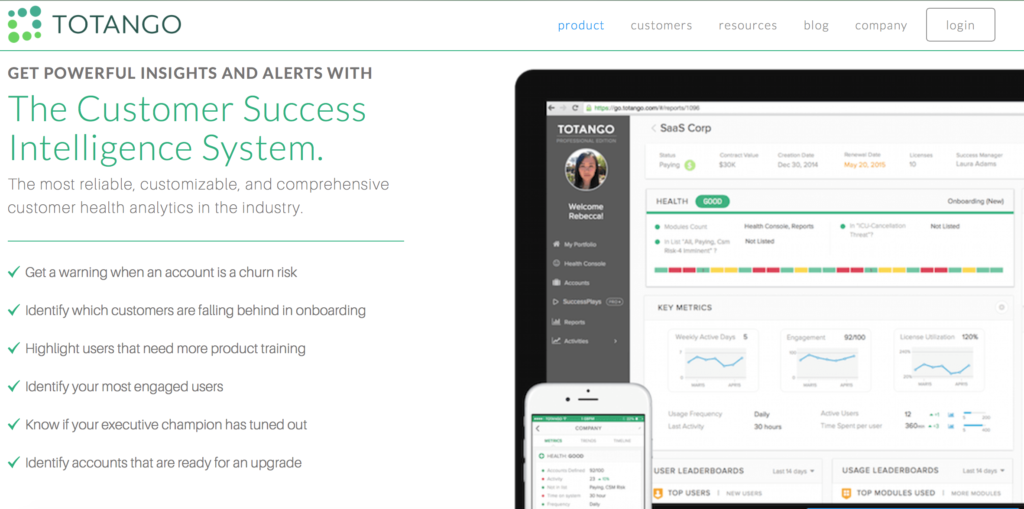

- Totango and Evergage: Comprehensive customer success tools that will notify you when an account is at risk for churn.

- Google Prediction API: Something useful your developers could integrate. It has a “churn analysis” feature, among many others.

- Intercom: A customer intelligence platform that has a built-in “Slipping away” segment, a daily report of customers who are inching toward churn.

- ChartMogul (Hi there!): A business intelligence product that analyzes your subscription data and tracks key metrics. You can use the customer segmentation feature to pinpoint accounts that exhibit these red flag traits.

See what Totango lists as their first product feature? Warnings for churn risk.

What exactly can you do when a red flag is raised?

To predict churn is to prevent it, right? It’s all about proactivity. Let’s look at ways you can address each red flag as soon as you see it — which might actually be before the customer even thinks of cancelling.

A customer isn’t logging in, or is logging in less frequently.

Set up an automated email campaign to get the customer’s attention and bring them back around. If that doesn’t work, a customer success agent could check in with them over the phone.

A customer hasn’t completed onboarding.

Drip emails throughout the onboarding process are always a good idea. If you have a campaign in place but customers are still falling off midway, set up a second layer of automate emails. Tailor these to where the customer fell off the onboarding path. Remind the customer of the major benefits of your product and their potential when using it.

A customer isn’t using key features.

Closely tied to the drip emails during onboarding, this string of emails serves as ongoing customer education. Ideally the customer would receive emails only about the features that they’ve neglected.

A customer stops contacting Support.

If a customer who actively contacted support suddenly goes silent, it makes you wonder whether they stopped seeing the point in seeking help or answers. Here it’s a good idea to send a quick email or make a quick phone call, just to check in and make sure everything is going well.

A customer has routine payment problems (consecutive late payments or service suspensions).

This is a sensitive subject, and one you should approach with care. Payment problems could indicate financial trouble, or just an expired/cancelled credit card. If it’s the latter, you should set up a series of dunning emails, designed to remind the customer to update their billing information.

A customer recently submitted an NPS of 6 or lower.

Personal conversation, all the way. The customer is paying you money, and they’re unhappy. Hear them out — they will feel better, and you will have learned a lot about them as a consumer and also about your product.

A customer’s point-of-contact changes.

Have a conversation with the new point-of-contact. Get to know them and their objectives in their new role. Of course they’ll know your aim is to resell your product and keep them as a customer, but it doesn’t need to be a sales call. Make the heart of the conversation about understanding their needs — and then demonstrate how your product could help.

Business or economic changes within the customer

A young company pivots; a customer is opening to new market segments; they get a new round of funding and plan to grow like crazy: All of these scenarios could lead to a shift in their business needs, which could be a shift away from your product. Keep your eye out for other red flags, too, and touch base with the customer.

Address a red flag as soon as you see it — which might actually be before the customer even thinks of cancelling.

Tweet this quote

Pay attention to what’s beneath the red flags, too.

Some churn might be a larger pattern in your customers’ lifecycles. Segmenting your customers into cohorts may reveal underlying issues that require more systemic solutions, more fundamental changes.

A big portion of customers always cancels in their fourth month? Retention not doing so hot with a particular vertical? Now you know there are some kinks in your product (or in how it’s sold, or in how these particular customers use it) — and while you work on smoothing those kinks internally, you can focus customer success on these at-risk cohorts to preempt any cancellations.

Final word

Ultimately, predicting and preventing churn comes down to understanding people’s behavior. What is the behavior of your happy, long-term customers? What do they have in common? Pay attention to whatever doesn’t fit that mold, to whomever behaves differently. Figure out ways to help them find more success with your product individually, or implement sustainable and scalable solutions on your end that can address a broad segment.

Through being so proactive with at-risk accounts, you’ll understand more innately your customers’ reasons for churn. You’ll learn how to prevent these reasons. You’ll build this prevention into the product itself, or make it a normal part of your customer success workflow. Your product will be better, and your team will be smarter; both will be more responsive to your customers’ needs. And so your customers will be more satisfied, and they’ll stay on board. And you will all… live… happily ever after.

Heartache averted.

Share and follow!

NEW on @ChartMogul: To predict churn is to prevent it — here’s how. https://t.co/mGrcIlJTql #SaaS #Churn pic.twitter.com/18CKg3RAz3

— ChartMogul (@ChartMogul) April 5, 2016