Ben Horowitz teaches us the traits of peacetime and wartime CEOs. In this article, I zoom in on the art of forecasting the future in this new wartime.

Arrested attention

With a pandemic underway, software-as-a-service businesses, in normal times the beneficiaries of relatively stable compounding growth, are now facing an existential threat: recurring revenue streams are drying up, at least in part.

In a matter of weeks, business forecasting and scenario planning — activities normally reserved for (and often relegated to) board rooms, have seized the attention of employers and employees across the globe. Like the sirens of an early warning system, SaaS dashboards are alerting revenue leaders to sudden changes in the direction and velocity of their key metrics.

In direct opposition to this surge of interest in projections is the outgoing tide of confidence in leadership’s ability to forecast with any accuracy. What better ‘Exhibit A’ than the pandemic itself, which they failed to predict?

And those early warning systems? Having successfully awakened us to impending danger, they’re now sending mixed messages — “Churn is up!” “LTV is up!” “Revenue is down!” “Trial signups are up!”

‘Are we turning the corner already? Was that the last wave of bad news?’ ‘I’m sorry, but we didn’t buy the night vision add-on … so we hope so … because now … we’re out of ammo.’

Marching forward

It’s true: no one’s March forecast included a global pandemic. But for 21st-century leaders, these kinds of cascading disasters can’t be swept under a force majeure clause. At least, not anymore. Employees, stakeholders, and shareholders expect guidance. And they will take it from those they trust the most.

21st-century leaders can’t sweep disasters such as the current pandemic under a force majeure clause anymore. Employees, stakeholders, and shareholders expect guidance.

Tweet this quote

How can we, as leaders, provide it? Models and projections have taken their own kind of beating. A post-truth marketplace is a hard place for nuanced data science, or as they used to call it, “lies, damn lies, and statistics.”

So how can we use the weapon of SaaS forecasting to fight back in a perilous time? By meticulously exposing all of the assumptions behind our forecasts until elementary math is all that remains.

This is not the time to be clever or to argue over algorithms. Instead, it’s time to take stock — a real inventory, of what we know, what we can’t know, and what we’re learning.

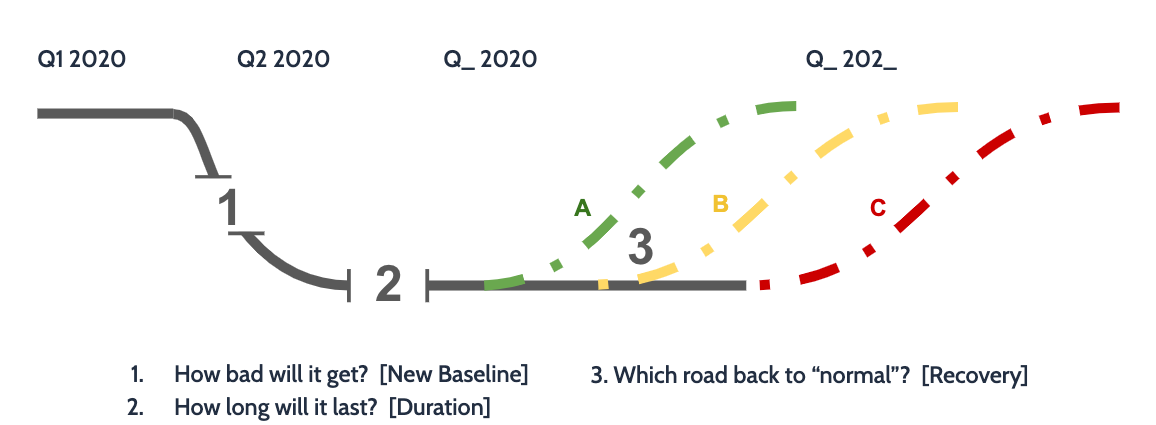

Broadly, there are 3 key assumptions on which our new forecast will be built:

- How bad will it get: what is our new normal?

- How long will it last: will we survive until recovery?

- What does the road back to normal look like: what should we expect?

These key assumptions pave a stochastic road into our future, like so;

At a minimum, when we share a forecast, we need to proactively share what our forecast assumes to be true about each of these answers.

Assumptions inventory

Now we can expand each of our assumption pillars with the goal of improving our forward-looking view.

Overwhelmed? This overall list (1–2–3) and each set of subpoints are logically ordered using General Eisenhower’s Urgent/Important method, so you can maximize your time-to-value simply by working top to bottom.

A good plan violently executed now is better than a perfect plan executed next week

Gen. George Patton

Still, keep in mind that “a good plan violently executed now is better than a perfect plan executed next week”. Once you’ve unearthed valuable unknowns from a point, try to move on to the next.

1. How bad will it get?

- Existing customers: This will hinge on the industries you serve, the demographics of our customer base, and, critically, the extent to which your customer’s success drives your own. Womply, a CRM provider for over 450,000 small businesses, has compiled impacts by industry. Pricing models that depend on the growth of a customer’s business to drive upsells — adding seats to a CRM, for example, may find themselves in an expansion revenue drought or even contractions. Similarly, volume-based pricing models need to admit uncertainty regarding the number of monetizable requests or transactions.

- New customers: Our “Crisis Cohorts” — new signups since the pandemic’s arrival, may behave differently than the rest of our customer base. Do we know the extent to which this month’s trial signups were driven by boredom or curiosity versus urgent demand for our service? Similarly, new subscribers may merit a double portion of attention from customer success, as these purchases are being made in a time when every expense is being scrutinized, and their success with our tool is more critical.

2. How long will it last?

- Cash for survival: What percentage of our customers are monthly payees versus annual? What assumption are we making in terms of this ratio going forward? Are any of our subscribers prepared to take advantage of a discount on an annual subscription? What will happen when the rate of subscriptions that enter dunning increases? Could we benefit from a SaaS cashflow solution like Pipe?

- Death to lurking vanity metrics: Uncloud your leading indicators reducing the number of numbers in your dashboards. Promote the metrics that signify business progress and demote the rest. It has never been more important to have a North Star Metric and to simplify your Minority Report heads-up display into an innovation accounting dashboard that reduces wasted dollars and effort. More than 4? Keep whittling.

- “In limbo” pipeline stage: Are we assuming our leads and opportunities will move through the pipeline at the same rate as before? How much are we expecting our “Closing — Waiting on Signature” stage to balloon? How will this impact our revenue forecast? Are we assuming new prospects will follow the same buying process and timing as before, or are we assuming they follow a different cadence? Do new prospects need refreshed collateral, perhaps focused on cost savings?

- Team productivity: How productive is each member of our team today versus before? What business processes are most impacted because of this? In some cases, individual ability focus may be higher. In many, if not most, it will be less. Have you surveyed your team, or are you running on assumptions? If the latter, admit it, then find out.

3. Which road back to normal?

- Ramping back: Are things getting better yet? When will it start? Perhaps it already has? Because timing is so difficult, it might be easier to think in terms of the shape of the ramp back to normal, rather than trying to guess the moment improvements will begin. We entered on the left side of a “U”, but the exit will most certainly look more like a “V” (linear) or “S” (a slow, compounding curve upwards). If your forecast assumes a dramatic rebound, explain why you believe this is the right assumption to make.

- More ramps: The macro trend above will remove headwinds, but internally, you have your own set of ramps to assume. How long will it take for your team to return to full productivity? Will it take longer for a customer to upgrade?

- The medium-term outlook: What if the virus returns to some extent in the fall of 2020? How will your Q4 change? This single assumption could have the greatest impact on your destination by year’s end. This article by Ed Yong in the Atlantic paints a broad picture of recurring waves of distancing and isolation prior to a vaccine’s development.

- The long-term outlook: How will the world change more permanently? Have you mapped the movements of individual components of your business and competitive forces? Is there a big opportunity ahead? Wardley Maps are the best tool for mapping the evolution of terrain over time.

A culture of SaaS forecasting

Done correctly, your new, wartime SaaS forecast for 2020 and beyond will be completed faster than any prior versions that emphasized numerical precision and accuracy.

Against your pride, I encourage you not to hide this MVP. Share it, complete with any holes and question marks, with other leaders within your business to check for the accuracy of what you do know, and then with your team and investors. Ask the latter to help their managers fill in the blanks, and in parallel, take action on what you know you know.

In this way, wartime SaaS forecasting becomes a collaborative exercise that spurs foxhole discussions that highlight and remove execution risks.

Your team’s need to know the direction you’re headed is an opportunity for bold leadership that humbly admits what it does not know and relentlessly communicates what’s being done to reduce the risk of the unknown. This wartime posture invites employees, shareholders, and partners to build their confidence in your grasp of the terrain and your adaptability — not your clairvoyance.