Introduction

In 2012, Paul Graham penned his famous essay Startups = Growth.

Graham makes a distinction between new companies — such as the thousands of restaurants and other service businesses started each year — and startups, for which growth is imperative.

He argues that this focus on growth comes from the unique setup of (technological) startups — they seek to identify a large market and create a product that is infinitely scalable (i.e. not constrained geographically or in any other way) and capable of capturing the whole opportunity.

Modern SaaS companies fall within that description. Cloud-enabled software is (almost) infinitely scalable by default, therefore finding and capturing a large market means you’re on a unicorn trajectory.

However, the same factors make it hard to achieve that path.

Even if you manage to identify a niche, high chances are others will notice the opportunity and try to take a slice of it.

And this is where growth comes into play.

Unfortunately, many founders think about growth as a feature. You pull a lever, you add a channel, and your company “grows”. In reality, what happens is that you add a little bit of revenue — and without much thought or a system behind it, you can never be sure that it is sustainable.

Growth is the result of retention, acquisition, and monetization

Brian Balfour and the team at Reforge, the leading experts in the field of growth, take a different stance. They argue that growth is a system with three elements — acquisition, monetization, and retention.

Instead of working on growth, you work on these elements and growth is the output you get out of the whole engine.

There’s a lot of attention that goes into two of those elements — acquisition and retention — but not nearly as much focus on the last piece of the puzzle.

On the flip side, what this means is that there is an opportunity in grappling with the monetization question for your business.

Founders always have an open path to improving their business by optimizing their monetization model. But to do it, they need to understand what it is first.

What is monetization?

Monetization is the sum of all decisions taken about when, what for, and how much to charge for your product.

Without generating value for your customers, you don’t have a business. But once you do, you have to find the optimal way to split that value between your customers and your business. This is one of the most important aspects of monetization.

One way to think about this is through the Product/Market/Pricing-Fit model introduced by OpenView’s Kyle Poyar.

It’s not enough to have a product that satisfies an existing need in a “big enough market”. You also need to deliver this product in a way that’s:

- sustainable for your customers (i.e. they get enough value for the price they’re paying) and;

- sustainable for your business (i.e. it allows you to pay the current costs of supporting the product, as well as to invest in its further development).

One common pitfall for those who decide to deal with their monetization model is that they focus solely on product pricing.

Pricing is the centerpiece of the monetization strategy

Yes, pricing is an essential element of your strategy, but it’s not the only one. There are other features of monetization, which are just as important. For example:

- What are you charging for? Are you using a value metric to align the benefits customers derive from your product with the price they are paying for it?

- Do you have a free tier to support customers who are just getting started, but have the potential to become paying customers?

- Are you offering a free trial so that potential customers can experience the value of using your product on their own? What kind of hurdles do they have to go through before they can experience it?

All these elements, along with the actual price you quote, come together on your pricing page. In the overwhelming majority of cases, this is the first point of contact your potential customers will have with your company.

Your monetization strategy — and your pricing page in particular — need to be able to explain and persuade your audience that using your product will generate value for them.

Thus, your SaaS pricing page has a critical role as the first conversion point your customers have to get through.

Pricing is the “gatekeeper” for your business

Your pricing model (and your SaaS pricing page) serve as the entry point for your customers.

The obvious way in which this works is that if your price is too high for a potential customer, they are never going to convert.

But a low price can be an equally big hurdle towards becoming a paying customer. A large enterprise buyer may hesitate if your solution is too cheap — because it introduces doubts about your business’ ability to continue investing in supporting and developing the product.

Even when they get the initial piece right, many founders repeat the same mistake — they set their pricing structure early in the existence of their company and once it works, they are afraid to touch it anymore.

But that makes it hard to find renewed sources of growth, once you’ve exhausted the initial market potential.

Pricing as the source of growth

Another trap that founders fall in is that they set their monetization model in the early days of their business and — if the business starts seeing success — they never touch it anymore.

Businesses are often afraid that customers are going to rebel if they change their prices.

We argue that revisiting your monetization strategy becomes more important with each passing day.

Early-stage SaaS companies grow by capturing more of their existing potential TAM (total addressable market).

In the early days, this is the safe way to approach growth. There’s enough room to expand without risking alienating part of your customer base because you decided to start charging for usage.

But, as you can hear from founders who operate on the ground, at a certain point you will hit a ceiling and realize that you cannot keep adding customers in order to hit your growth targets.

There are 2 important points about monetization you have to consider. First, you can’t really monetize from an existing user base, if your SaaS pricing is not designed in a way that their bill grows along with their usage of your product.

In addition, it’s great to have a high retention rate, but how meaningful is that if that huge enterprise customer you signed on $10/month is still paying you the same amount (even though the value your product delivers has grown manifold)?

Yet, this is where many teams fumble the ball — they start expanding horizontally or start adding consulting gigs to their product. There are few cases in which this works as planned.

Looking at your monetization strategy should be your first stop when exploring the ways to reinvigorate growth. This is what we’ve heard from experienced founders, such as Buffer’s Joel Gascoigne.

I knew it wasn’t feasible to expect that the next 10x in growth would come from adding another 700,000 (10x) customers.

Joel Gascoigne, Buffer

Revisiting their plan structure and pricing (i.e. their monetization), allowed the team to increase the Average Revenue per User (ARPU) and find a path to start growing healthily again. All the questions monetization raises need to be answered by one specific asset of your business — your SaaS pricing page. Your pricing can serve as a growth lever only if it is communicated well.

Why your pricing page matters

Your pricing page is where you communicate your monetization strategy. It needs to provide clear answers to all the aspects we touched upon above.

No matter how good a growth engine you have and how perfected your monetization approach is, it will never turn to success if your customers are confused when they come to your website.

That’s why the pricing page is an essential element of every SaaS business. Your monetization strategy is only as good as your pricing page.

All the effort and resources that go into improving onboarding or cutting churn by 0.5% are a waste of time and money if your pricing page isn’t optimized to attract your ideal customers in the first place.

A good pricing page has 4 essential elements, it needs to convey in order to be successful:

Transparent

As a basis, a customer browsing your SaaS pricing page should understand how much you’re going to charge them and for what exactly.

Every time a customer emails your team asking why they’ve been charged a specific amount, it’s very likely that your pricing page has failed in fulfilling this basic job.

Further in this report, you will see how smart teams use the chat widget on their pricing page to answer customer questions — and quickly learn from their customers, so they can improve their pricing page.

Strategic

Another important task for your pricing page is that it should help you attract the right customers at the right price point.

For example, if you’re serving both SMB and enterprise customers, you want to sign up customers from each segment on the plan that’s best fit to deliver value to them.

As we discussed above, undercharging big customers is going to generate just as many problems as overcharging the small ones. If your potential enterprise customers perceive you as too cheap, they will start to wonder if you’re also low-quality and if you have the team to support and develop the product.

This is another reason why you shouldn’t be afraid to revisit your SaaS pricing page (and strategy) and make changes as your customer makeup shifts.

One of the questions we address in the Analysis section of this report is whether your pricing should be public or not. You will see that there is no definitive answer. While most companies strive to make their pricing as transparent as possible, there’s a specific well-defined minority — those targeting enterprise customers mostly — who are very likely to offer only customized pricing.

Aligned

When you’re getting a new customer on board, you want to make sure they have the right set of features that will allow them to experience the value of your product.

There’s an endless set of possibilities when it comes to features, add-ons, and upgrades you can offer. However, adding too many only risks creating confusion.

Finding the right balance and communicating it clearly on your pricing page is the key to success in this field.

On-brand

You shouldn’t forget that your SaaS pricing page is also part of the overall brand experience you’re providing. The voice, tone, and design you’re using should match the overall feeling they will get from using the product and talking to your sales or customer success teams.

How we created this report

Communicating all of the above on a single page that can’t carry too much copy by default isn’t easy.

Thankfully, you’re not alone. Hundreds of founders and operators have gone through the process of setting up their monetization strategy and their pricing structure.

Their learnings are demonstrated in hundreds of SaaS pricing pages, available publicly on their sites.

In this report, we looked at over 600 examples, derived the biggest learnings from them, and packed them in a form that is easily digestible.

We hope you find it useful.

Demographic Data

To get a better understanding of the companies we’ve included in the report and why you should trust the findings, we want to share some information about the selection we’ve made.

Here’s the high-level view on the companies we’ve looked at to compile this report for you.

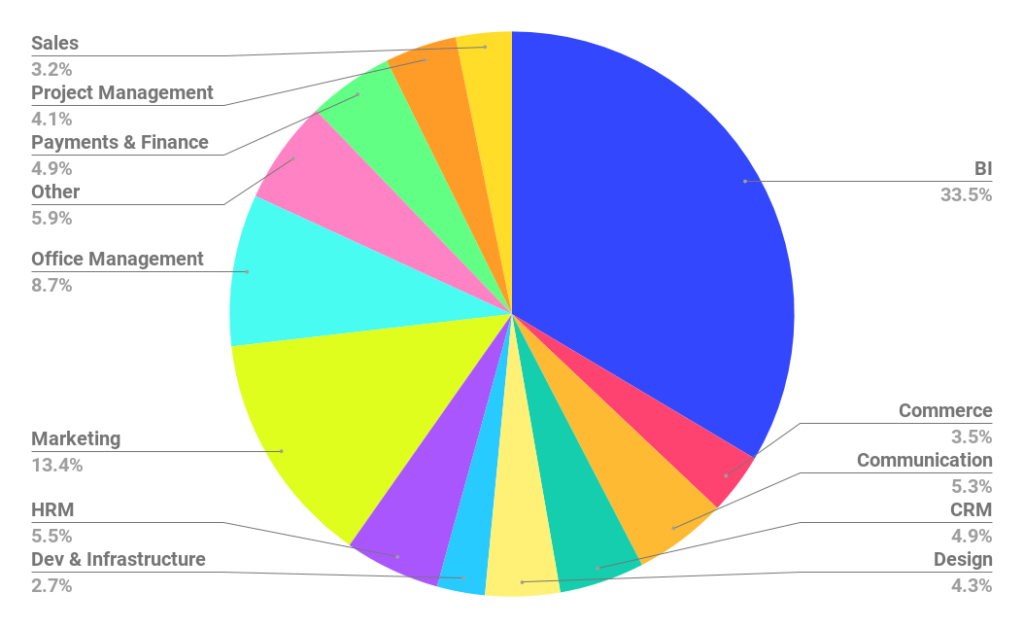

Industry vertical

Over a third of the examples operate in the Business Intelligence vertical. The other significant chunk comes from the Marketing category. This is hardly surprising, given the Martech category (that also includes a number of analytics products we’ve filed under Business Intelligence) numbers over 8000 companies as of the last check.

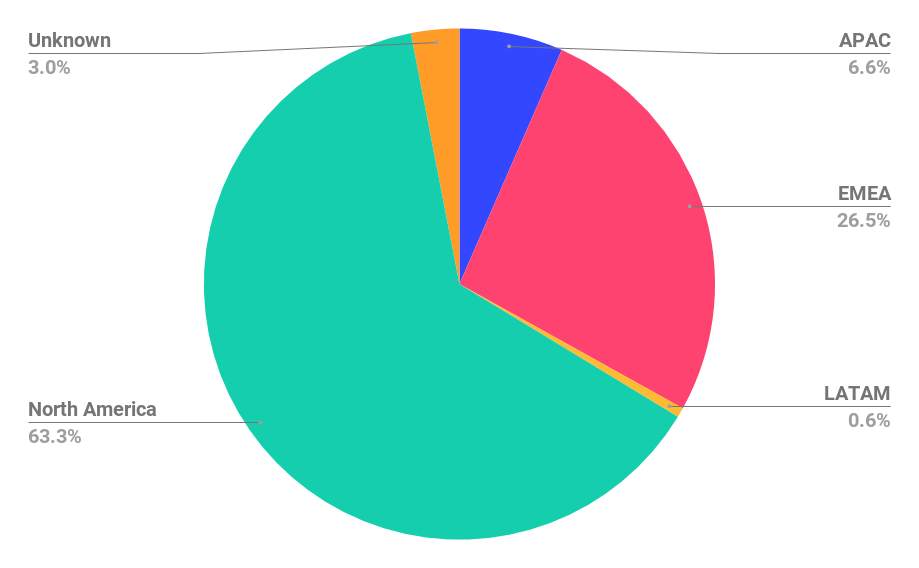

Location

The majority of the companies in our sample are from North America with EMEA (Europe, the Middle East, and Africa) a distant second.

We’ve tried to keep this representative of the overall split of SaaS companies across the globe.

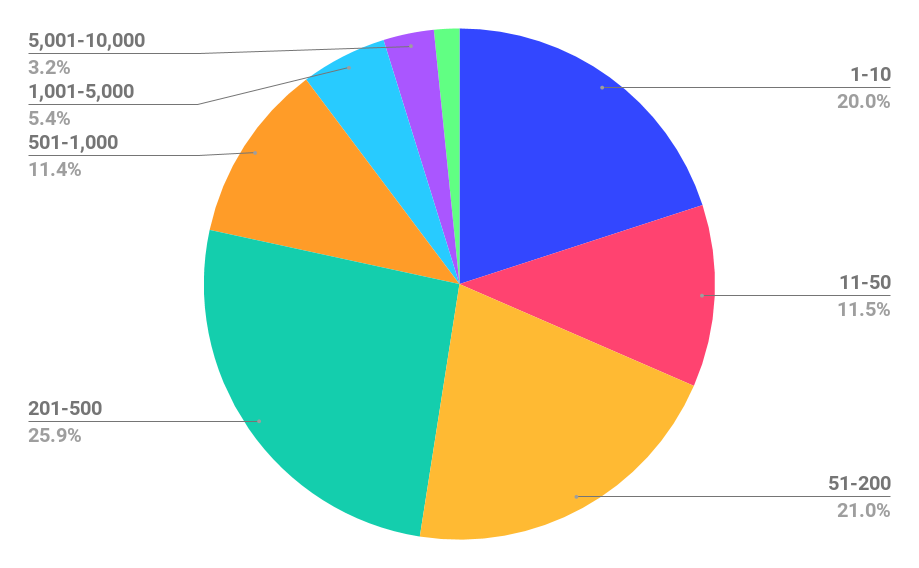

Size (as # of employees)

About half of the companies have fewer than 200 people on their roster. Another 25%+ run with a team that numbers less than 500 people.

Most SaaS companies are what would be considered small businesses in most of the world.

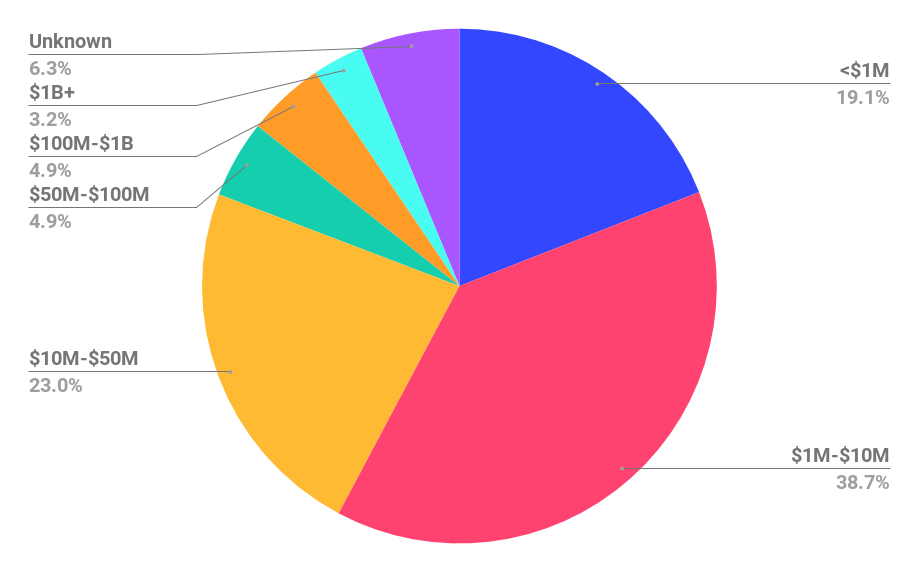

Revenue (as Annual Recurring Revenue or ARR)

Over half of the companies we’ve included in this report are yet to break the $10m benchmark.

However, no matter whether you want to look at the SaaS pricing page of a company that’s just getting started or a unicorn, there’s something for every taste in our report.

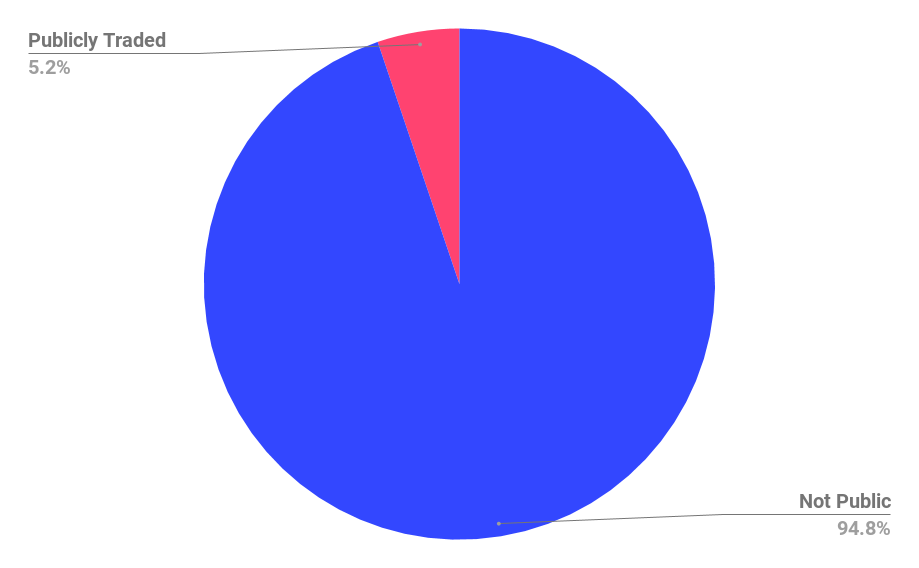

Public vs. Privately-Owned Companies

It’s no surprise that the overwhelming majority of the companies in our sample — as well as most SaaS companies in general — are privately owned. In most cases, that also includes VC-backed companies.

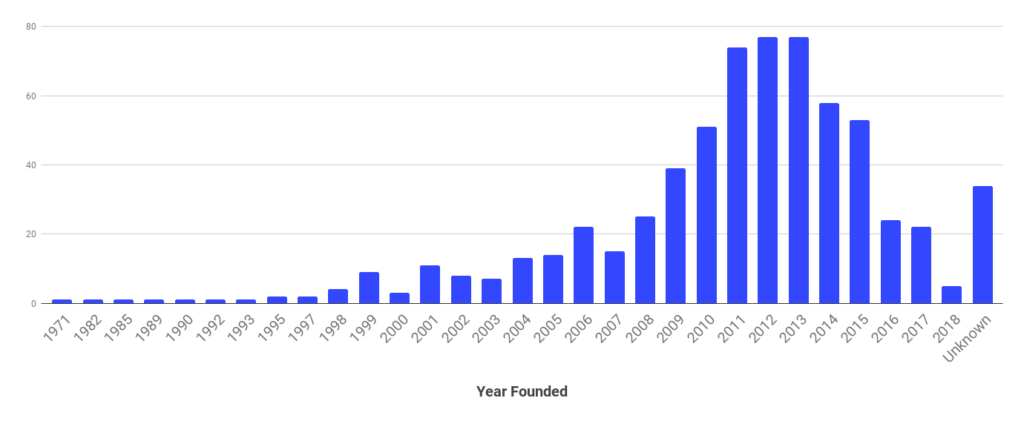

Year Founded

Finally, we’ve included data about the founding year of each of the companies in our sample.

It seems the “Golden Age” of SaaS was around 2012-2013 with most companies following a normal distribution around that period.

The SaaS Pricing Report

Let’s now look at the actual data to find the best ways to approach the pricing page conundrum in 2020.

We believe this approach is the best, as it gives you real information from what SaaS businesses like yours have found to work.

We have aimed to answer the most common questions we hear about SaaS pricing, by comparing various data points about the pricing pages, as well as demographic data about the companies, but our analysis only scratches the surface.

If you have other questions, you can get answers to them by heading over to the Data section and using the filters there to find the specific examples you’re interested in.

Here are the answers we’ve set out to find.

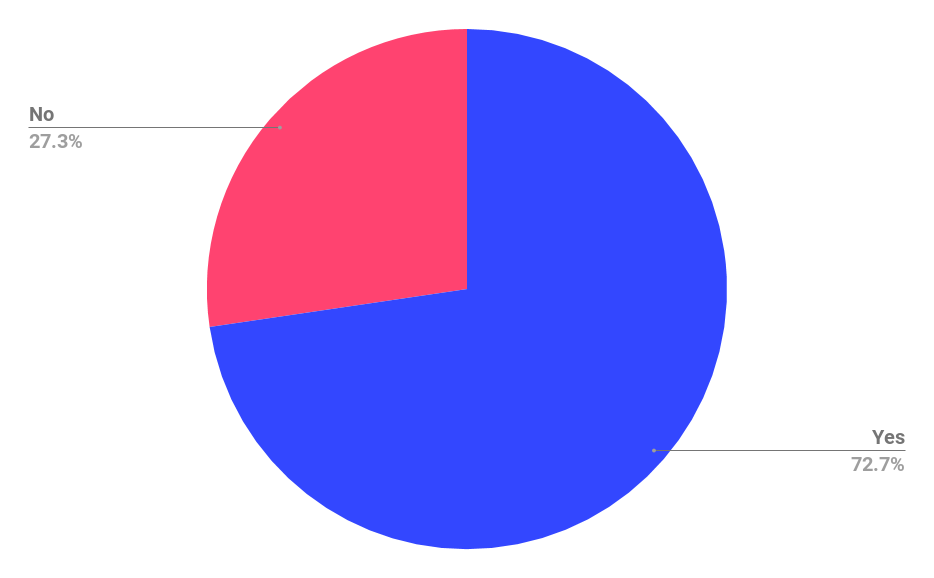

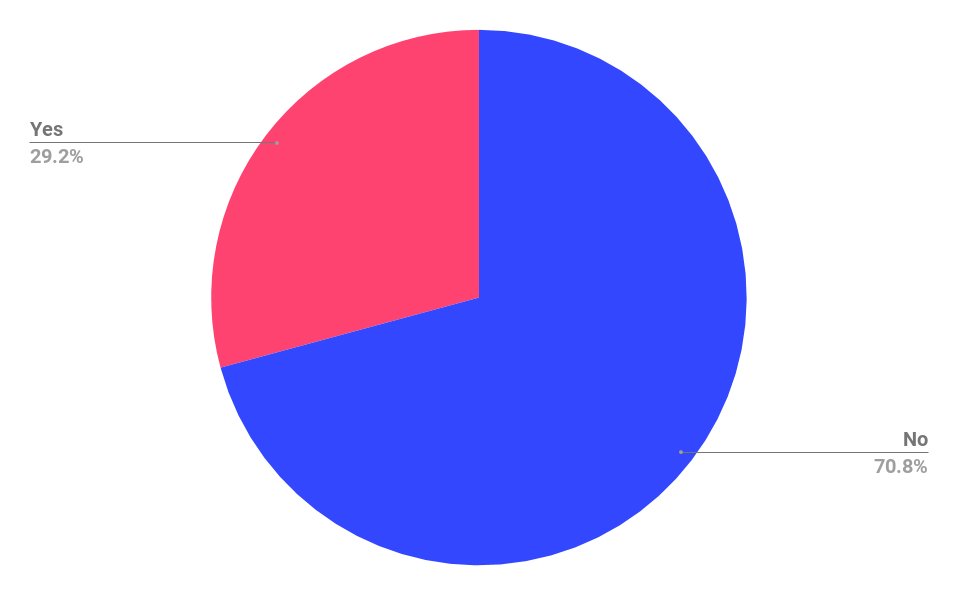

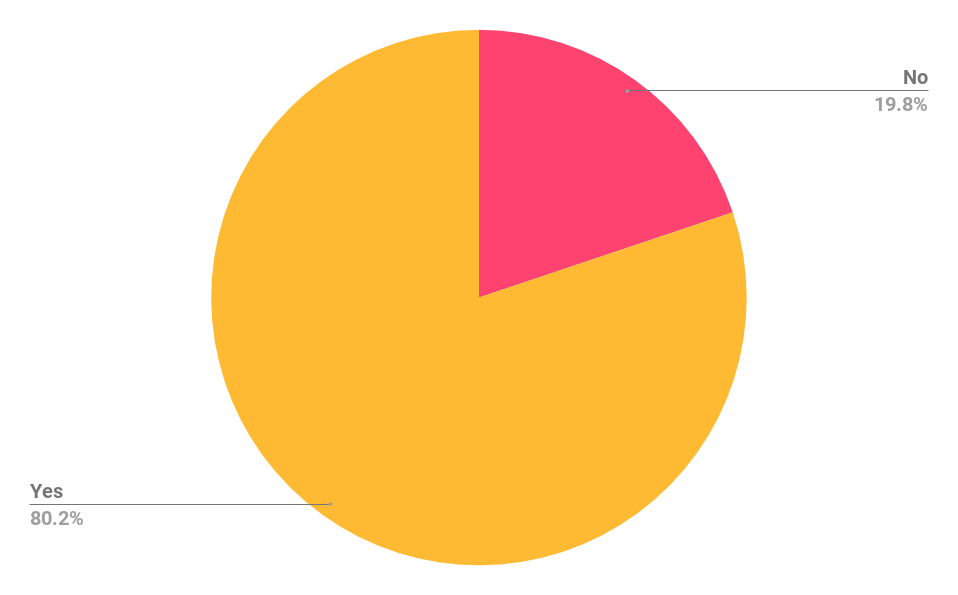

Should you list your pricing?

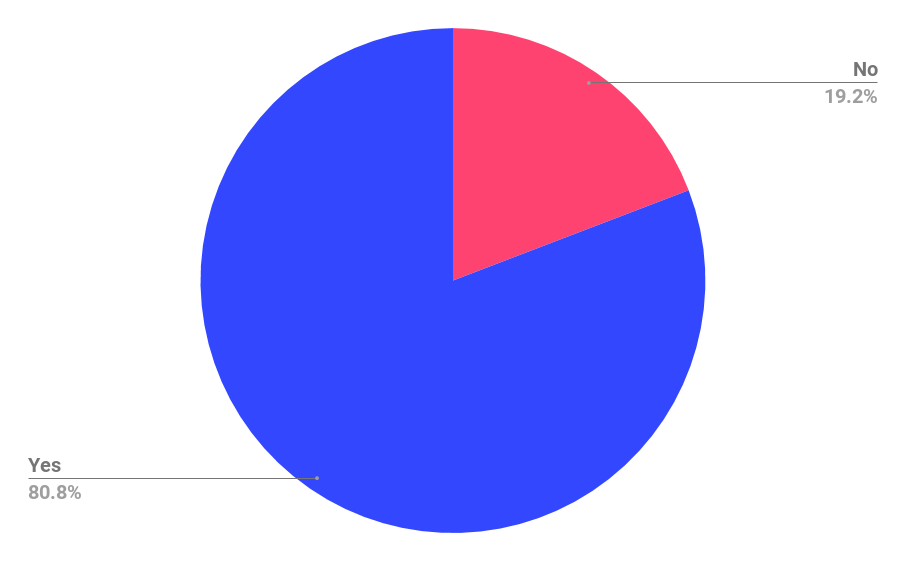

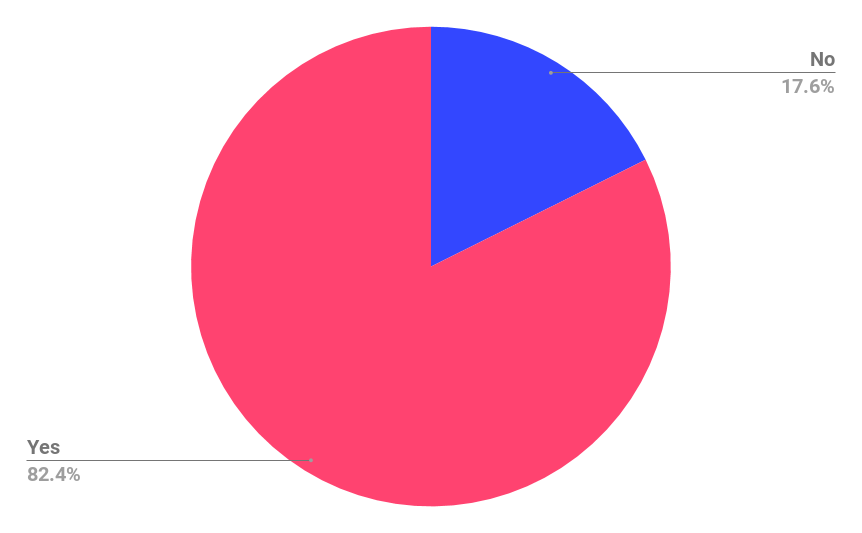

The answer to this question seems clear, but a quarter of B2B SaaS companies still don’t list their pricing on their site.

While the majority of companies display their pricing publicly, over a quarter still don’t feature theirs on the website.

Which begs the question:

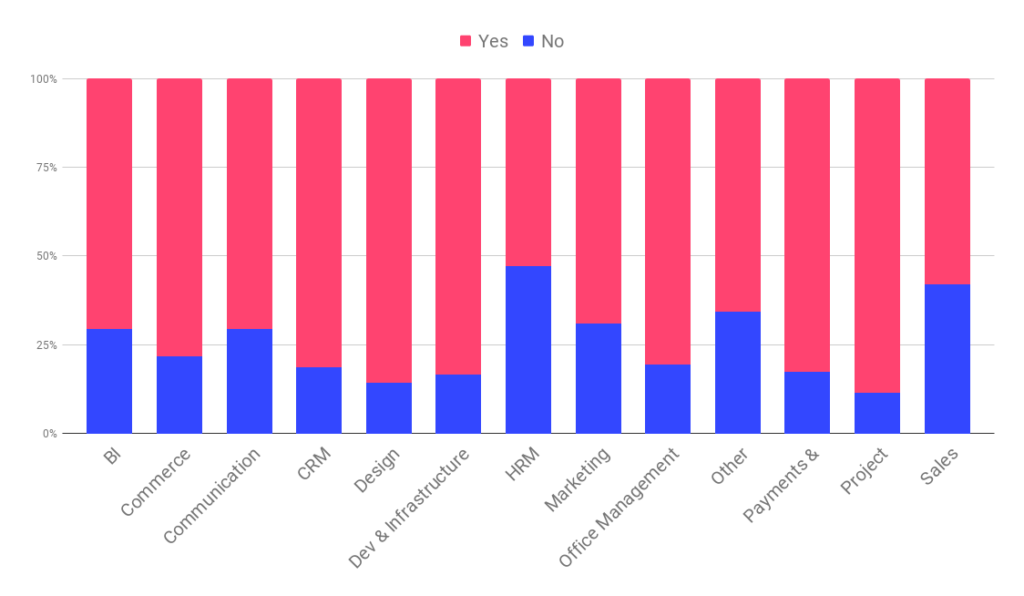

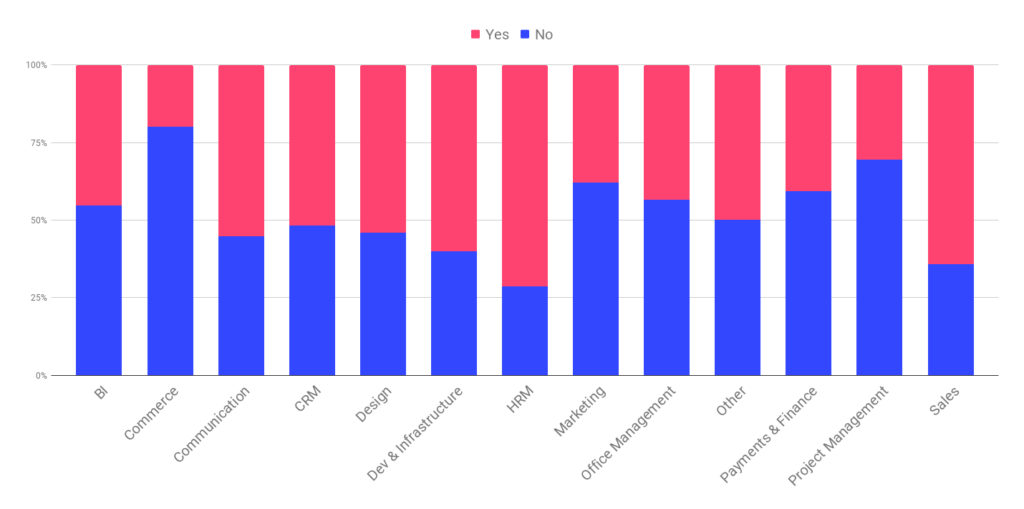

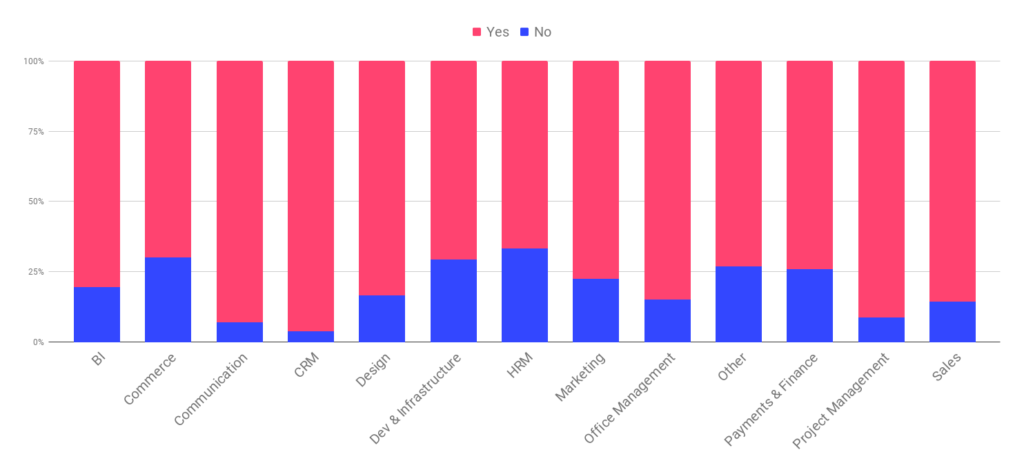

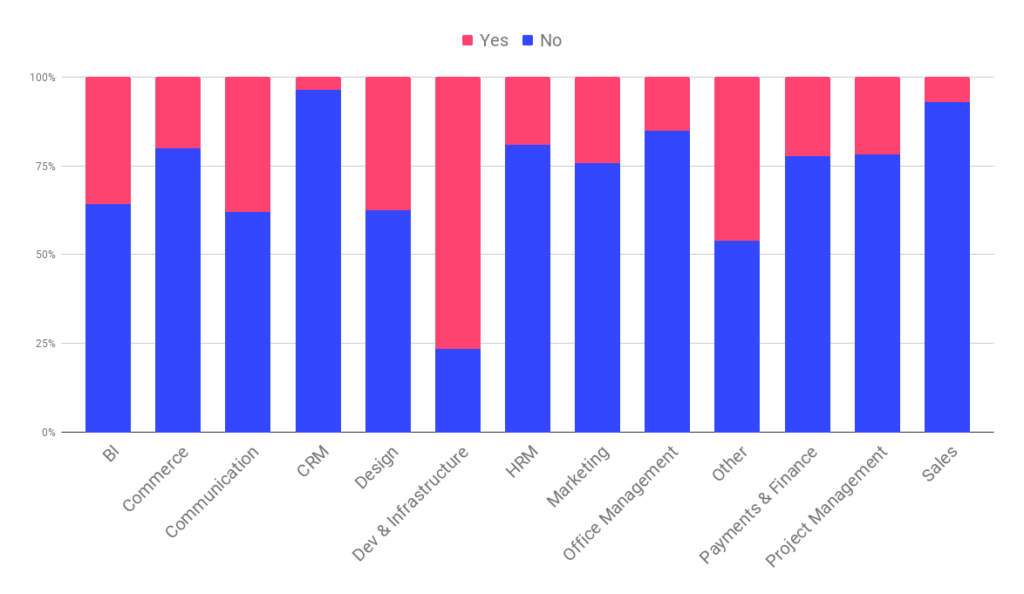

Which verticals are less likely to display their pricing?

Pricing transparency is a popular discussion in SaaS. Sales velocity, friction, and the margin are some of the factors that influence the decision of whether a company should display its pricing or not.

Our initial hypothesis was that companies who sell to larger (enterprise) customers probably have incentives to keep their pricing private, so they can provide a custom offer to each customer and avoid being undercut by competitors. The leading thinkers in SaaS seem to agree on this:

We don’t have a data point for the type of customer these companies are targeting in our data — because that kind of data is seldom shared publicly and even harder to infer — but we thought we could use some of the information we have as a proxy.

We looked at the industry vertical of each product as one such proxy. Companies that score significantly higher than average tend to offer products that fall under the Human resources management (HRM) and Sales categories.

In the HRM category, nearly half of all companies do not have pricing listed. The fact that companies that offer HR solutions typically target bigger companies with large workforces points in the direction that our hypothesis might be correct.

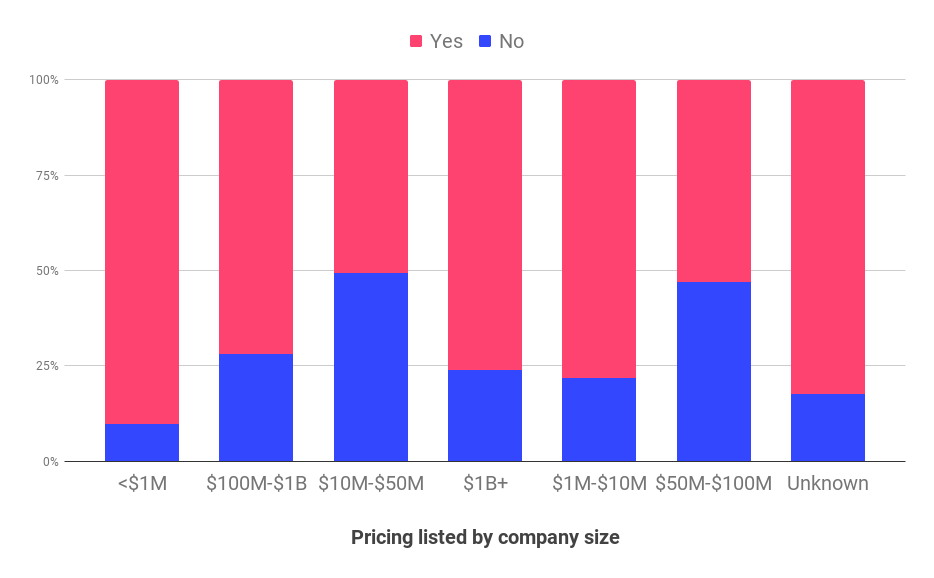

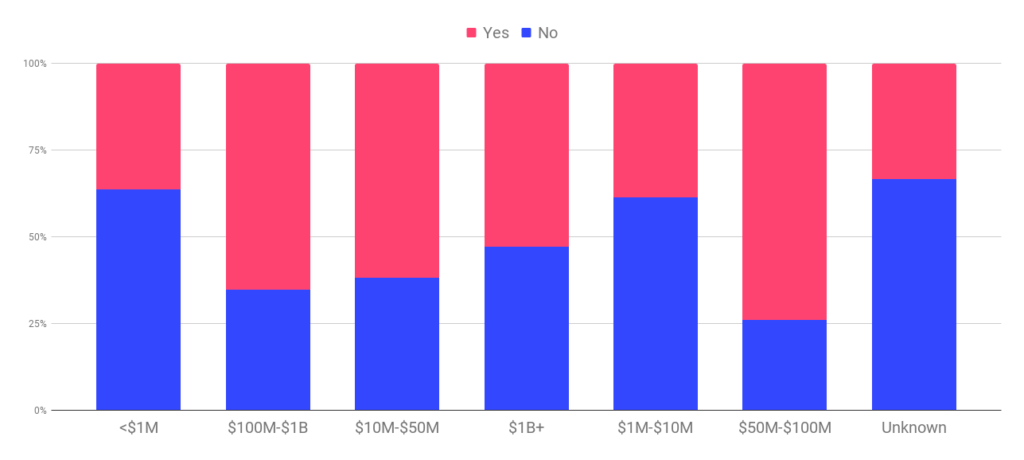

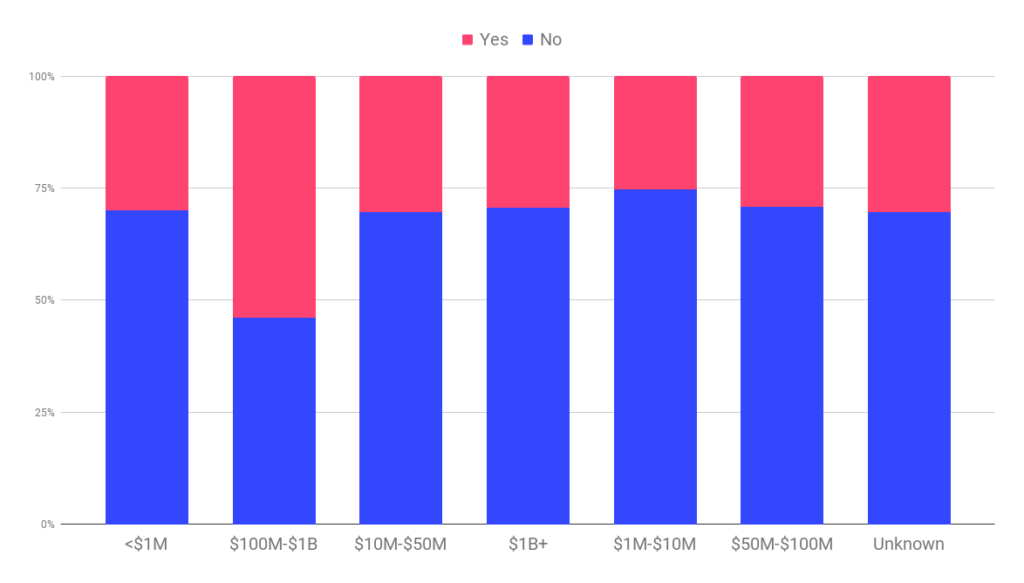

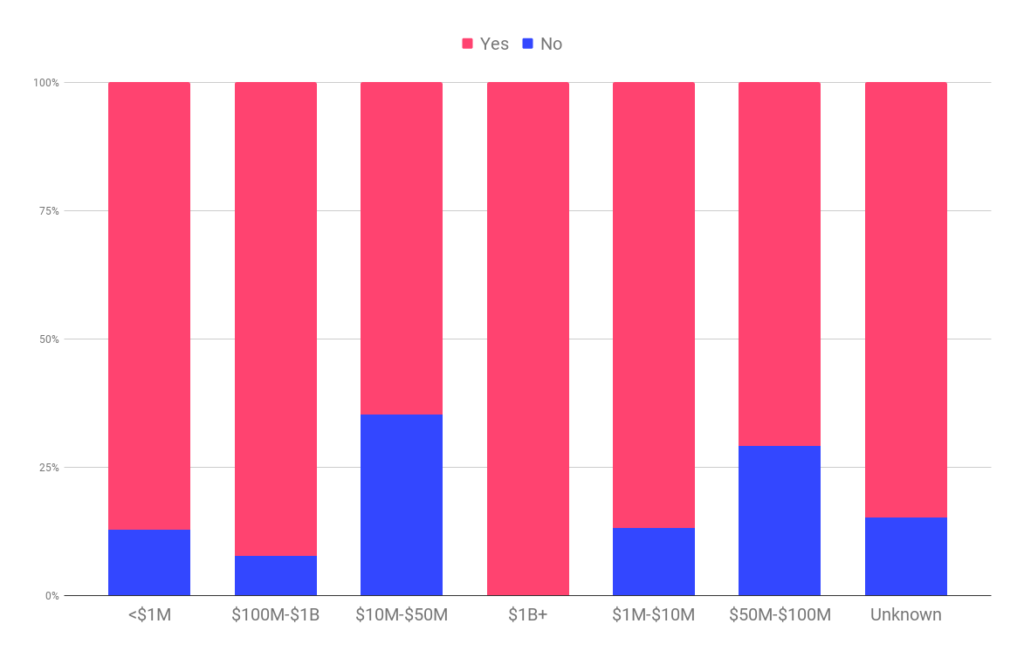

Another way to look at the data is to see if there are discrepancies in the likelihood of sharing pricing publicly based on the annual revenue (ARR) of the company.

It seems that companies that generate between $10m and $100m in ARR are significantly more likely to keep their pricing private.

This seems to confirm our hypothesis as companies in that segment are much more likely to be targeting enterprise customers.

In some cases, this focus is easy to spot — as in the example above from ClearCompany.

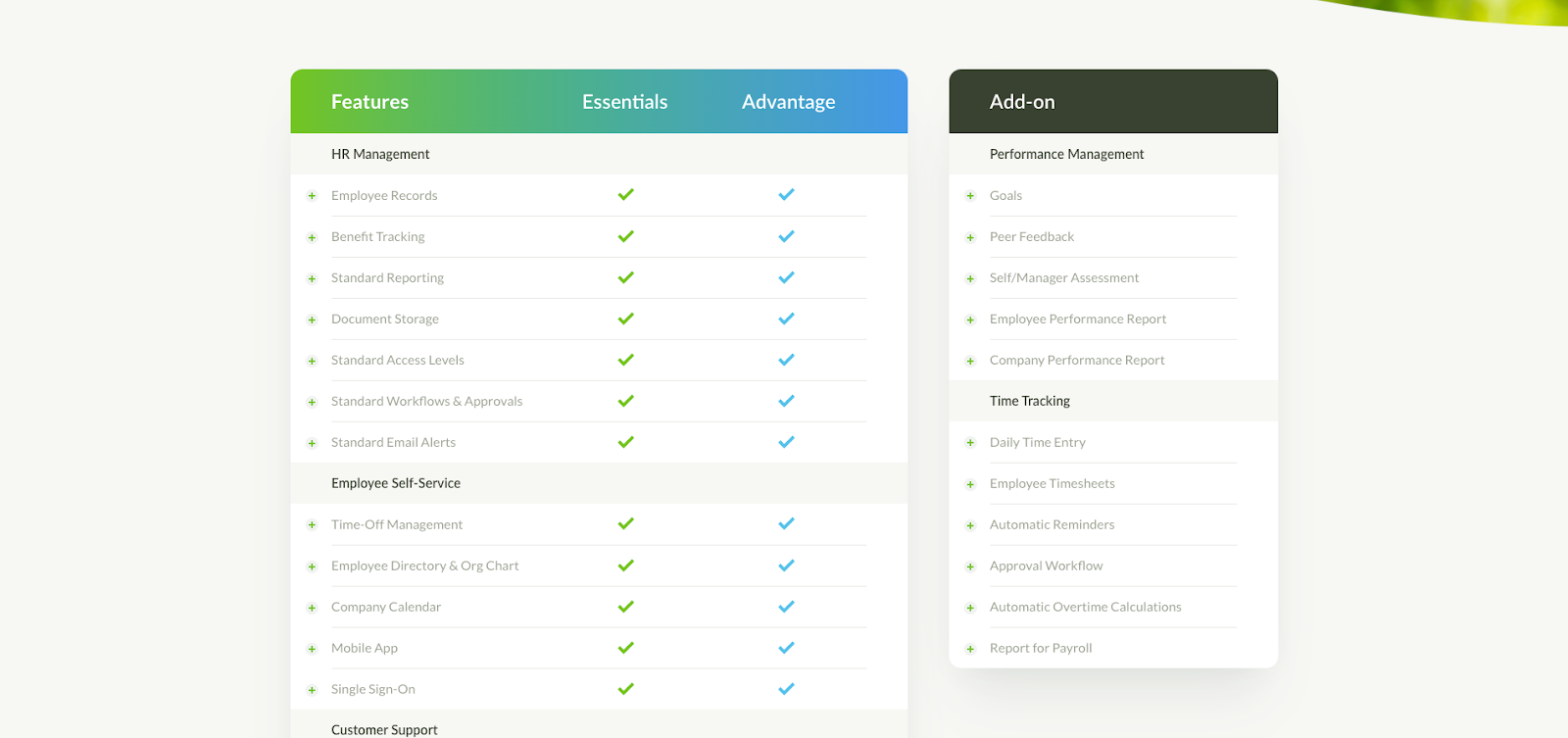

Case in point: BambooHR

BambooHR is a good example that you can build a highly engaging and informative pricing page even if you’re not offering a self-service model.

BambooHR uses its pricing page to explain all the diverse features and add-ons the software offers. Even without an explicit pricing structure, the company hints at the existence of at least two specific pricing plans, with various add-ons that can be added to each.

A great feature of listing all the features is that the user can still do a self-serve evaluation of what the product offers, before contacting sales. Listing features clearly and not hiding them is a user experience best practice, even if you aren’t listing your price. Even if the pricing page does not serve as a conversion tool, it has its place as a mechanism to generate leads for the sales department — the Get a Free Price Quote CTA triggers a short form that visitors are asked to fill and submit.

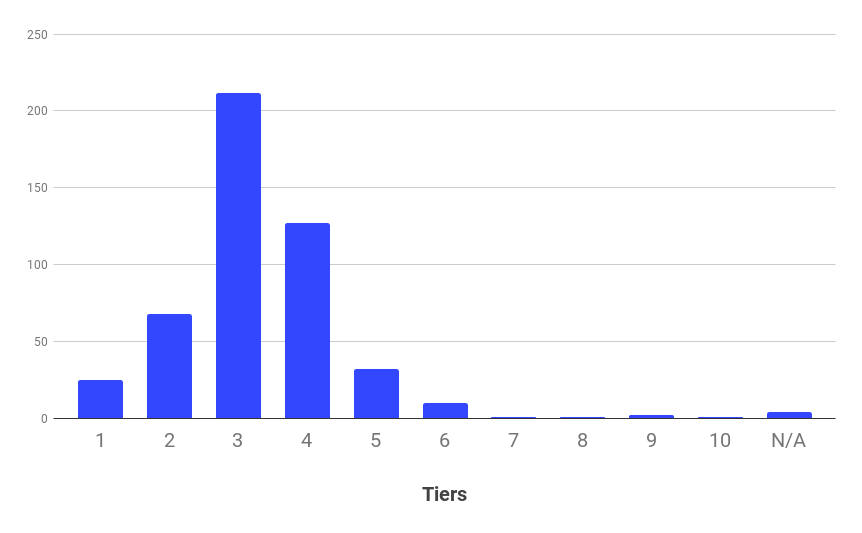

What’s the optimal number of plans?

Three is still the magic number when it comes to tiers in B2B SaaS. Close to half of all companies in our report offer three separate tiers.

However, an interesting trend we see is the emergence of modular pricing. The typical example is companies that offer so many different features and add-ons that every customer gets a customized prize for the exact features they want to use.

This is typical of companies that offer hosting/infrastructure and/or implementation/consulting services as part of their offering.

Modularization is a good approach to lower the barrier to adoption while maximizing the revenue you generate from your customer base.

It allows you to align the value customers receive to what they have to pay, while at the same time keeping the overall bill affordable to all types of customers — even those who only need to use your software for a limited and very specific purpose.

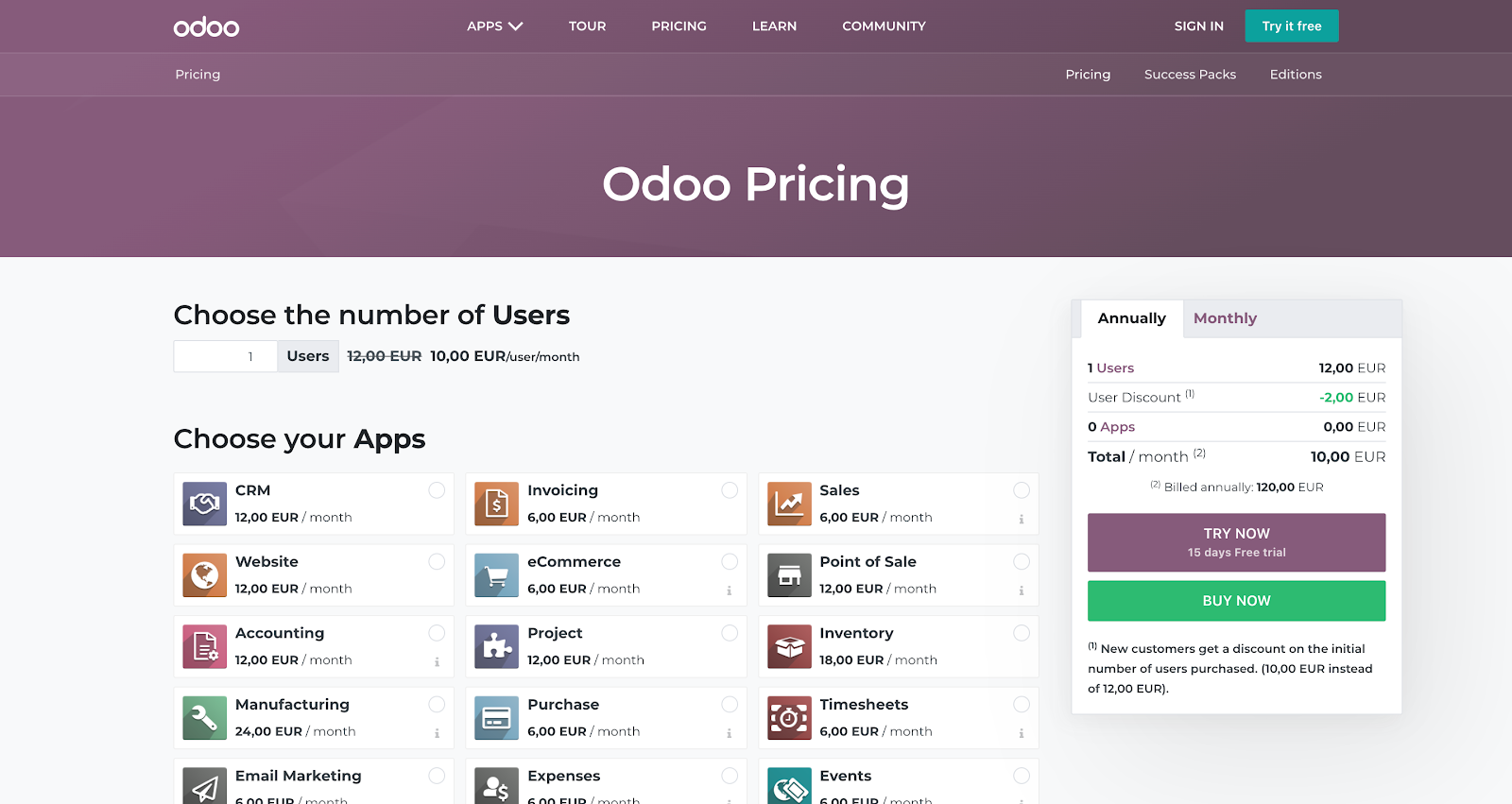

Case in point: Odoo

Odoo is an all-encompassing business management software. The product offers multiple different apps that span all aspects of running a business — sales, project management, marketing, etc.

Because of that Odoo doesn’t even have a single specific plan — they charge per user, in addition, customers pay a small fee for each app they want to use.

Moreover, Odoo also has add-ons for specific integrations, the type of hosting their customers want to use, and for helping implement and adopt the software.

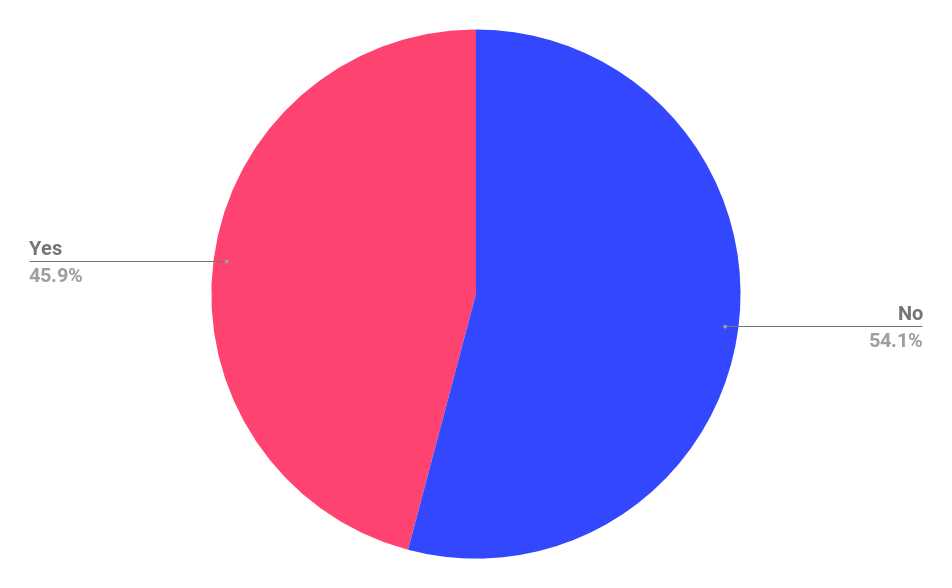

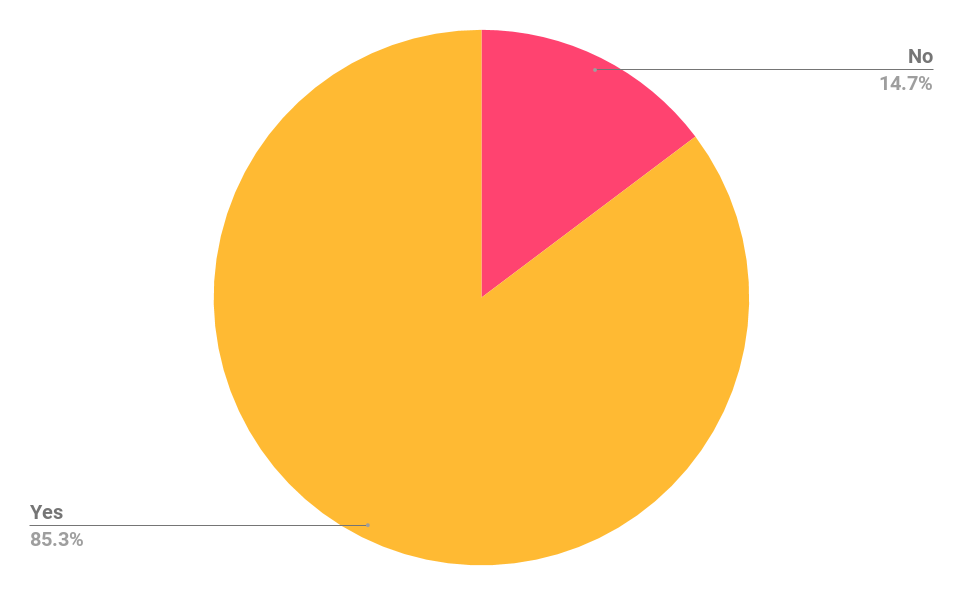

Custom plans

A discussion about SaaS tiers wouldn’t be exhaustive without looking at how many companies offer custom plans.

What we mean by a “custom plan” is what companies often mask as a separate pricing “tier”, but what is simply an invitation to speak to their sales team and get tailored pricing that often includes some kind of volume discount in exchange for a longer-term commitment.

It seems that the industry as a whole doesn’t have a single opinion over the necessity of offering a custom plan.

The companies in our report are split nearly halfway in terms of offering a custom plan.

However, similar to our analysis of public SaaS pricing in the previous section, we need to dig deeper to understand what kind of companies are using this tactic in their pricing/monetization strategy.

With custom plans, SaaS companies often aim to attract larger customers, so we believe that we are most likely to see them practiced by SaaS companies that sell to the enterprise.

Segmenting by niche shows us a familiar picture — companies operating in niches that target predominantly larger companies (such as human resources management) are much more likely to offer a custom plan.

We also looked at how likely SaaS companies are to offer tailored pricing based on their overall revenue.

Smaller companies (under $10m in ARR) are noticeably below average on this factor — especially the smallest companies that are making up to $1m in ARR.

On the other extreme, it’s not the biggest SaaS companies that use this tactic, but those companies that find themselves in the $50-$100m band. This seems to suggest that going after an enterprise market — and offering the custom pricing to go with it is a popular way to grow your SaaS business when you exhaust the initial self-service potential.

When we realized we wanted to take the company public one day, we realized we had to sell to the enterprise.

Yvonne Wassenaar, Former CIO, New Relic

Deep insight: The winding road of growth

It seems that when it comes to monetization strategy, companies have to be ready to change gears several times in their existence, to keep growing.

In the beginning, typically up to $10m in ARR, SaaS companies have to optimize their self-service funnels — that means offering transparent pricing and multiple plans that allow customers to sign up with a low-touch approach.

Between $10m and $100m in ARR, the potential of the self-service funnel to sustain growth usually stalls. Founders and CEOs realize that adding the same number of customers that brought the company to this stage, is not feasible.

I know that it wasn’t feasible to expect that the next 10x in revenue would come from adding another 10x — or 700,000 according to the count at the time — customers.

Joel Gascoigne, CEO, Buffer

At this stage, many founders realize they have to go for higher-caliber customers and grow their ARPU (average revenue per user) to continue growing.

At this point, many SaaS companies start hiring and expanding their sales teams. However, it seems that this approach also has its limitations.

We’re increasingly seeing a clear trend towards SaaS companies relying primarily on their products to grow, especially when they reach the $50-100m revenue band.

They use self-service funnels, value metrics (we look at those further in the report), and sales loops to support the product-led strategy.

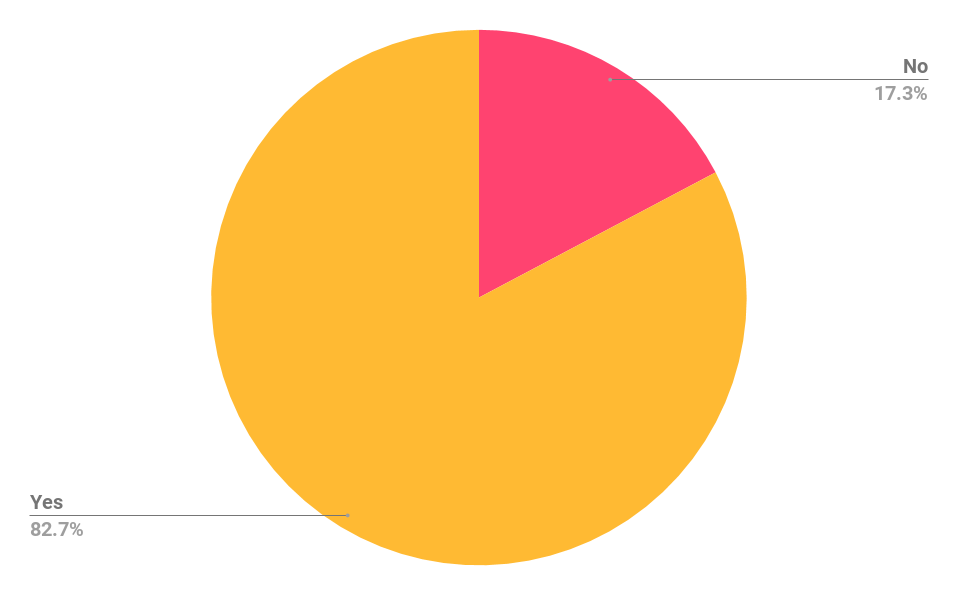

The free trial — still an industry standard?

Our research shows that the majority of SaaS companies use free trials as a common tactic to acquire new users.

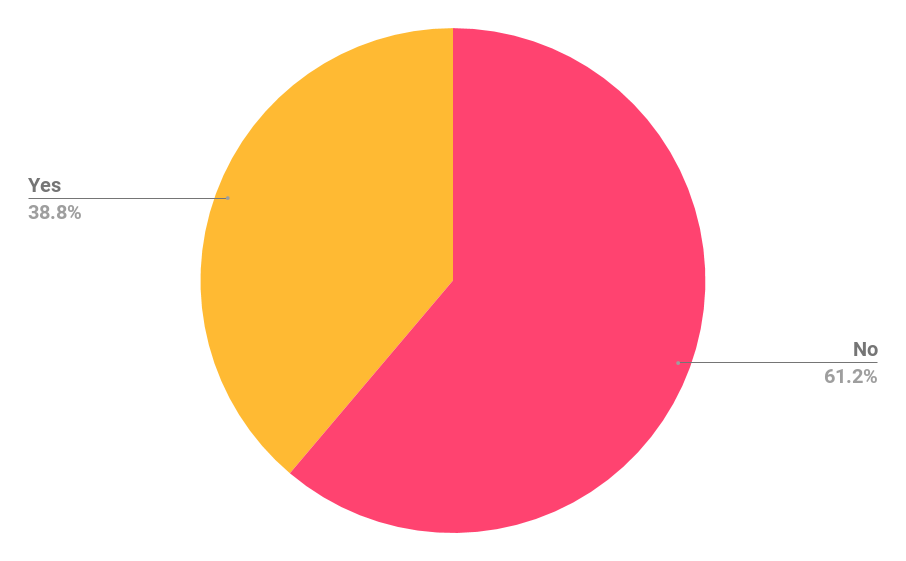

We were also curious to see how many SaaS brands allow users to start trials without entering credit card details. This option is a lot less popular — less than 40% of SaaS companies offer it.

We can get a better view of how that is spread across the industry when we look at these two data points across verticals.

With such a dominance of the free trial across the industry as a whole, it is not surprising that it is popular in every vertical. However, we can see that in some industries, there’s still a significant share of companies (typically at least 1/4 of all products in a specific sub-category) that don’t offer this option.

These are typically products in categories such as Dev & Infrastructure, Human Resources Management, and Payments & Finance. We believe this is because adopting a new tool in these categories requires significant investment in terms of work and resources — both on the side of the provider of the product, as well as the adopter.

Therefore, SaaS companies in these verticals use the lack of free trial as a way to push away customers who are not a good fit for the product, so they can focus their resources on serving those who are properly positioned to benefit from their product.

Additionally, as you will see further into the report, many of the companies in these verticals offer freemium plans that allow users to experience the product before buying, so they don’t need to offer a free trial.

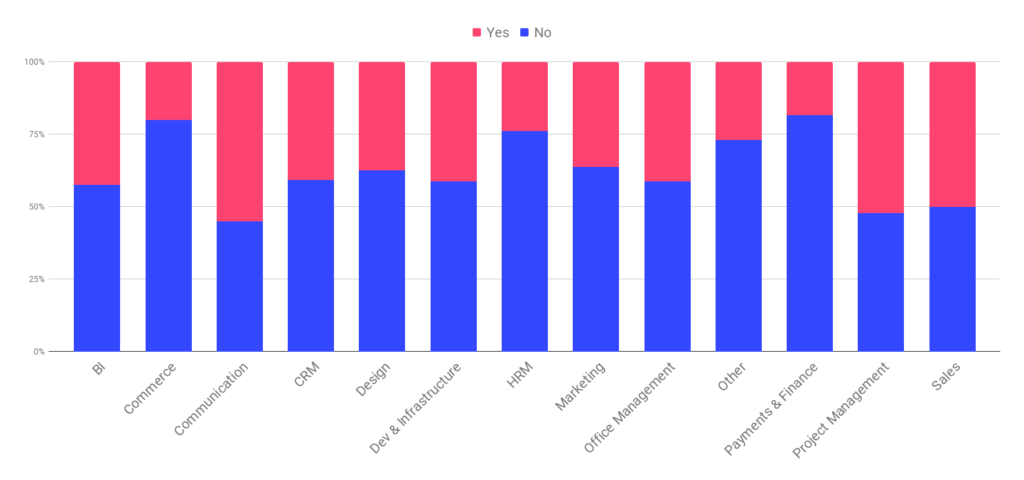

The cardless trial — When is it a good option?

As we saw above, the option to start a trial without entering your credit card data is not that established in SaaS even in 2020.

However, if we look at the data per industry vertical, we can see that there’s a clear trend with cardless trials being significantly more popular in some niches:

The majority of SaaS products in the communication and sales categories offer this option — we believe that these products rely on strong network effects. So, their main goal with the trial is to get people to start one, experience value as quickly as possible (doing work to import contacts and exchanging messages in the meantime), and get locked in.

SaaS founders are making a bet on removing all obstacles in the name of getting customers locked down in using the product.

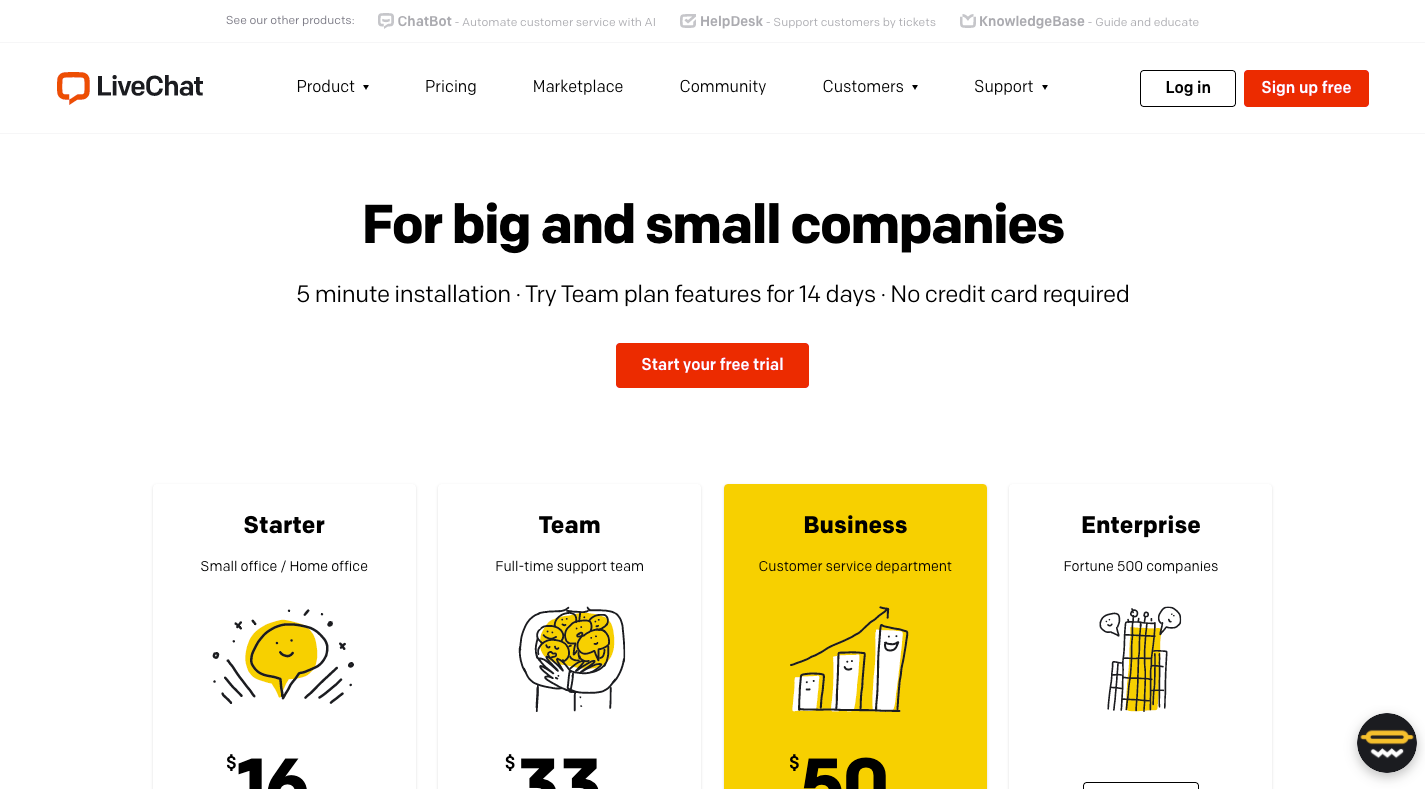

Case in point: LiveChat

LiveChat is a fairly standard example of a SaaS free trial — 14 days, self-service. Unlike most companies that use this tactic, however, LiveChat doesn’t require customers to input their credit card data:

The space for live chat tools is heavily saturated with large competitors (like Intercom, Drift, etc.) dominating most of the space.

Companies like LiveChat, who want to operate in this niche, have to be very nimble and smart about how they capture and convert customers.

Once a LiveChat user has started a new trial and has done some work to set up bots, the company has a strong chance of turning them into regular customers — if they have experienced the value of the product, they are unlikely to go to another tool and start the whole process from scratch, losing all their progress.

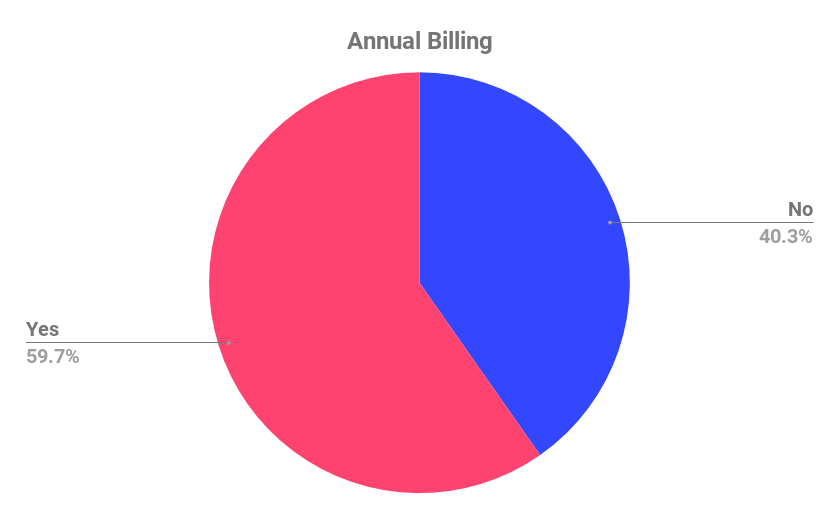

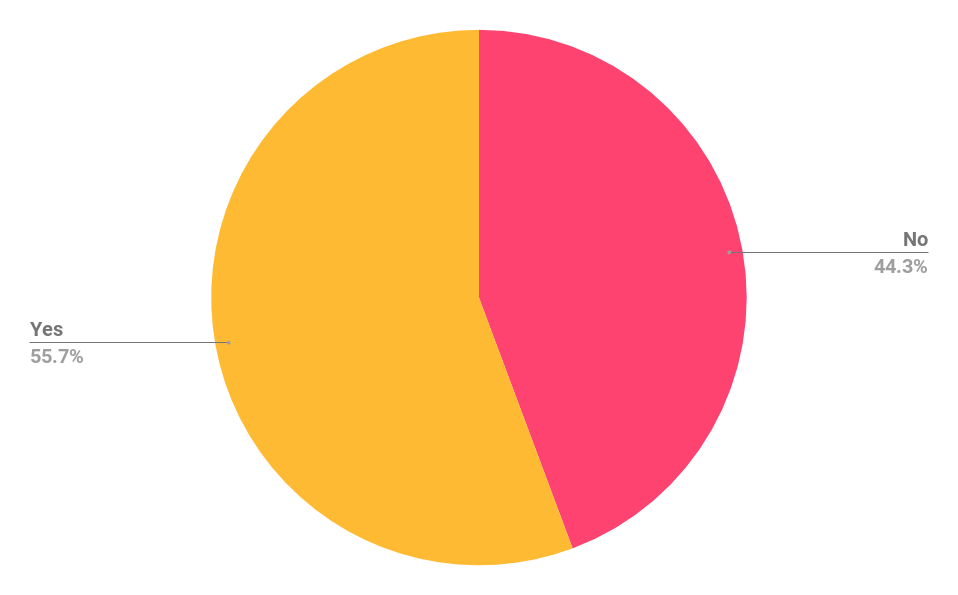

Annual vs. monthly billing

One of the most common debates in SaaS is whether you should offer your customers a choice when it comes to how often they pay you — every month or just once for the whole year.

Many have weighed in on the topic, but the experts seem to agree that you strive to make it easy for your customers to make a decision. What does the data suggest?

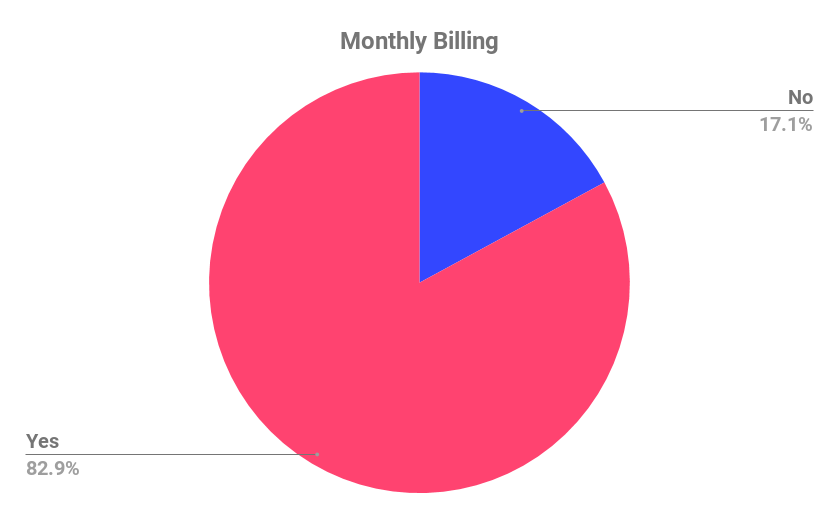

Monthly billing seems a lot more widespread. We weren’t surprised to see it dominate, with over 80% of SaaS companies charging on a monthly schedule.

However, we were slightly more surprised to see that over 40% of the companies in our sample do not offer annual pricing for their customers. Especially provided the popular belief that longer contract terms lead to lower churn.

So we decided to look at some of the examples of companies that do not offer annual pricing in an attempt to figure out what is driving this decision.

Case in point: Whereby

Whereby is a video conferencing software that is quickly gaining traction because their software can be used out of a browser (without downloading a standalone app) and also thanks to its unique set of collaboration features.

Whereby looks like a fairly typical SaaS company, where you’d expect to see annual pricing — so why aren’t they offering it?

There are several interesting features about Whereby’s pricing, but if there’s one common theme — it’s simplicity. Whereby offers 3 tiers, but in reality, they are just 1 tier for each type of customer they serve — a Free plan for casual users, a Pro offering for prosumers and those who need video conferencing for their professional needs, and a Business plan for companies and organizations.

The lack of annual pricing is just another feature in the same general direction — Whereby wants to avoid making their pricing more complicated and harder to parse out.

Keep in mind that you can always offer your users more features down the line. Whereby can afford to sign up new users on the Free plan and start working to convert them to a paid monthly (or even annual plan) once they’ve experienced the value that Whereby provides.

This gives us a nice segue to follow into the next part of the discussion — and how important is product-led growth for SaaS companies.

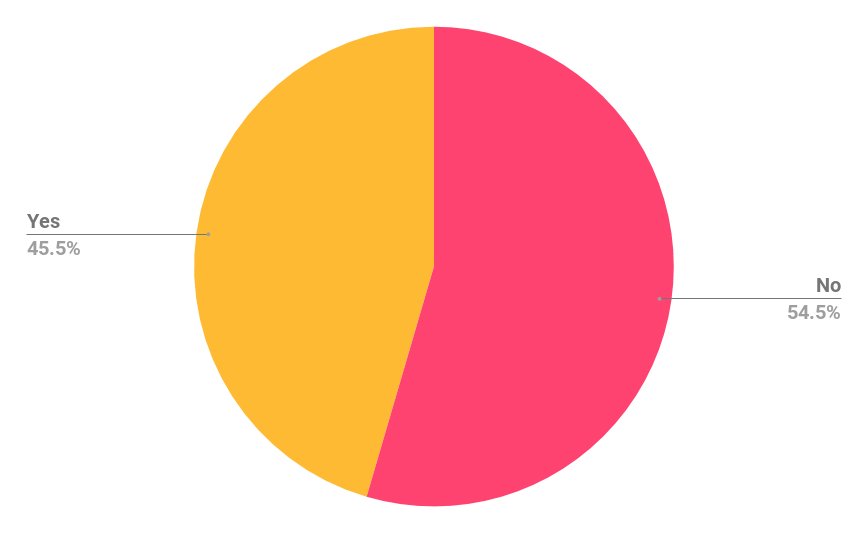

Freemium: A necessity or just a way to generate bad leads?

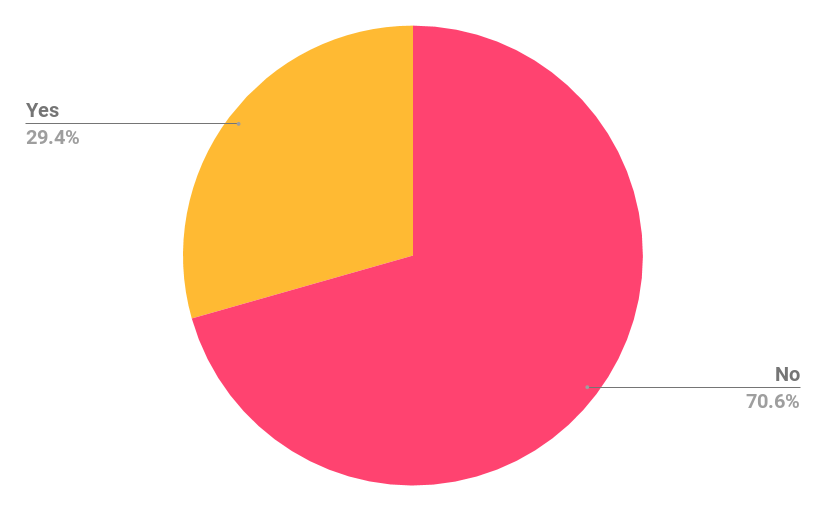

Product-led growth is a popular topic in SaaS today. But is it more of a topic for discussion or an actual strategy that subscription companies use to grow?

One of the most important and popular manifestations of a PLG strategy is freemium pricing — i.e. offering a free plan with limited resources and asking customers to upgrade to a paid offering, once they need more.

We believe that looking at how SaaS companies use free plans is the best way to understand the impact of PLG.

While the total share of companies that offer a free plan doesn’t look so high — less than a third of companies offer this in their SaaS pricing — we knew we had to dig deeper to understand the true opportunity of this measure.

To understand what companies take advantage of freemium pricing, we segmented our data by industry vertical and ARR size.

Freemium is a good tactic for products with “rising consumption”

Dev & Infrastructure products are a fairly small share in our sample of SaaS companies, but it’s not a coincidence that freemium plans are so dominant in this segment.

Offering a free plan is a very good way to price discriminate and provide just the right amount of value your customers need at any given point in their development. The added benefit is that you generate trust and loyalty with those who are too small and too early into their journey to pay. This is the best moment to do it — at this stage, there’s little competition for the hearts and minds of those customers and a free plan is a cheap and easy way to capture them.

Freemium is a good growth engine to put your company on a growth trajectory

Another trend that we’ve noticed in the data is that growing companies on the path to $1B in ARR are much more likely to offer a free plan to their users. It is worth mentioning that many of these companies choose to monetize backwards — they add a freemium plan once they have nailed down the product and exhausted the potential of the free trial to generate an early user base.

Freemium is not just a marketing tactic to generate leads for the sales team. Free plans are an essential element of product-led growth.

The role of the users generated by such free offerings is not just to create a revenue pipeline for the company (although that certainly is the main goal). Free users also feed growth loops that generate even more users for the product who in their turn a) convert and b) invite more users.

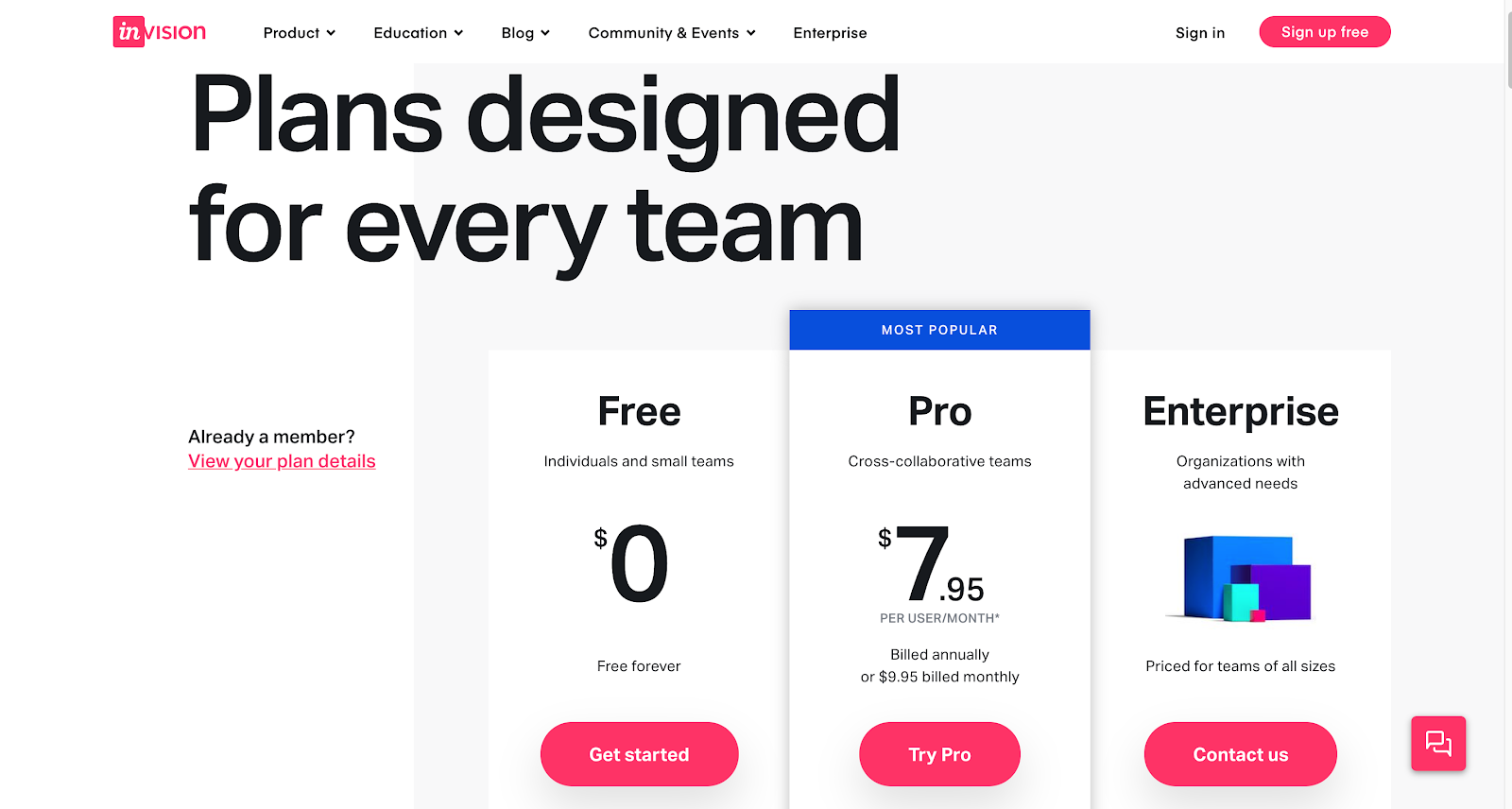

To get a feeling for what this looks like, let’s consider a tool like InVision:

A new team signs up and starts using InVision. Soon enough, they are sharing their designs and prototypes not just internally, among the team members, but also with clients, partners, and users. Some of the people who are exposed to InVision’s product in this way will start accounts on their own — the free plan helps with this by lowering the friction — and continue to feed the loop.

Thus, we see how a tactic that looks simple — even wasteful — on the surface, has a big potential to generate positive benefits for the companies using it. It is not a surprise then, that some of the fastest-growing SaaS companies are using it.

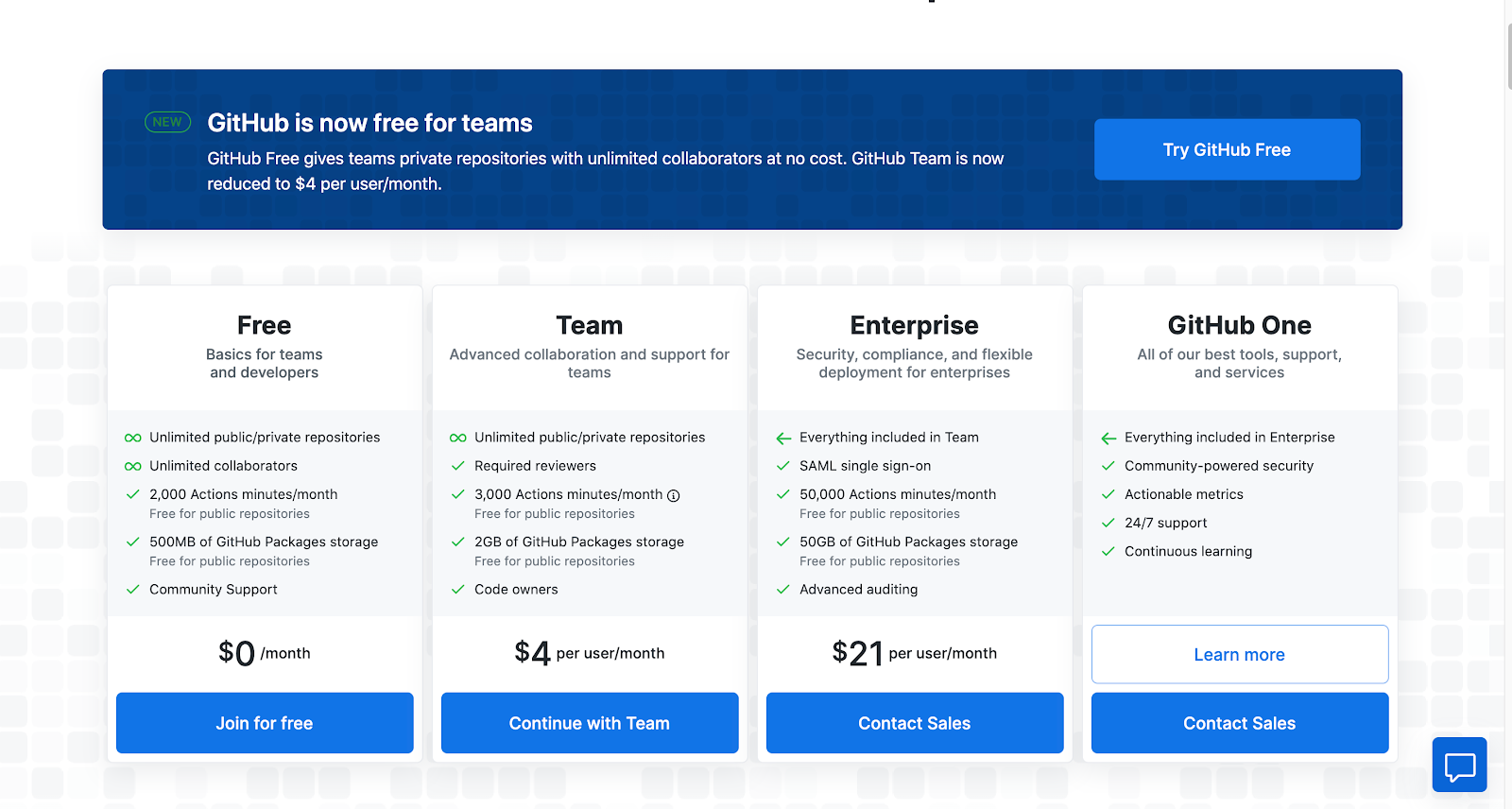

Case in point: GitHub

GitHub is perhaps the most popular development platform in the world that thousands use to host and share software projects.

GitHub offers a very generous free plan that can be used by individual developers and whole teams alike.

Take a good look at GitHub’s pricing and you’ll notice that they don’t limit the one feature in the product that has the power to feed a growth loop, similar to the one we discussed above — the number of collaborators and (shared) repositories. Using this has allowed GitHub to become the de-facto standard in development and an essential part of every tech stack. This led to a $7.5B acquisition by Microsoft in 2018.

Upselling: How to achieve Net Negative Churn in SaaS

One constant feature among the most successful SaaS companies is the fact that they grow their revenue from their existing base faster than they churn customers.

Because of this, Net Negative Churn is treated with veneration by SaaS founders and VCs and as one of the strongest signals about the potential of a SaaS company.

Reminder: How to Calculate Net MRR Churn Rate

The rate at which MRR is lost through downgrades and cancellations, offset by account expansions.

Sum of churn & contraction MRR – Sum of expansion & reactivation MRR / MRR at start of the period

How to achieve Net Negative Churn also attracts a lot of debate. At its core, it’s a matter of upselling. We included 2 features in our data that explore how SaaS companies are upselling and growing revenue from their existing customer base — scalability (which is closely tied to value metrics) and offering add-ons in your pricing.

Scalable pricing: Align your success with your best customers

The most successful monetization models in SaaS are those that align the interests of the company with those of its customers. The most common way this is achieved is by using scalable pricing — or one where the price grows as the usage of the product (and the value derived out of it) grows as well.

This is usually achieved through the use of a value metric in the pricing. Value metrics are a hugely important topic in SaaS. And based on our data, it seems that the debate has been concluded once and for all.

A large majority of B2B SaaS companies use scalable pricing — the question, which remains, is whether they are using the correct value metric for that scalability.

What is a value metric?

A value metric is a specific indicator that is demonstrating that your customers are getting more value out of using your product. The true power of scalable pricing is generated when you manage to tie it to a metric that serves as a proxy for how much value your customers are getting out of your product.

We see too many companies, which still opt in for the safe “per seat” pricing option.

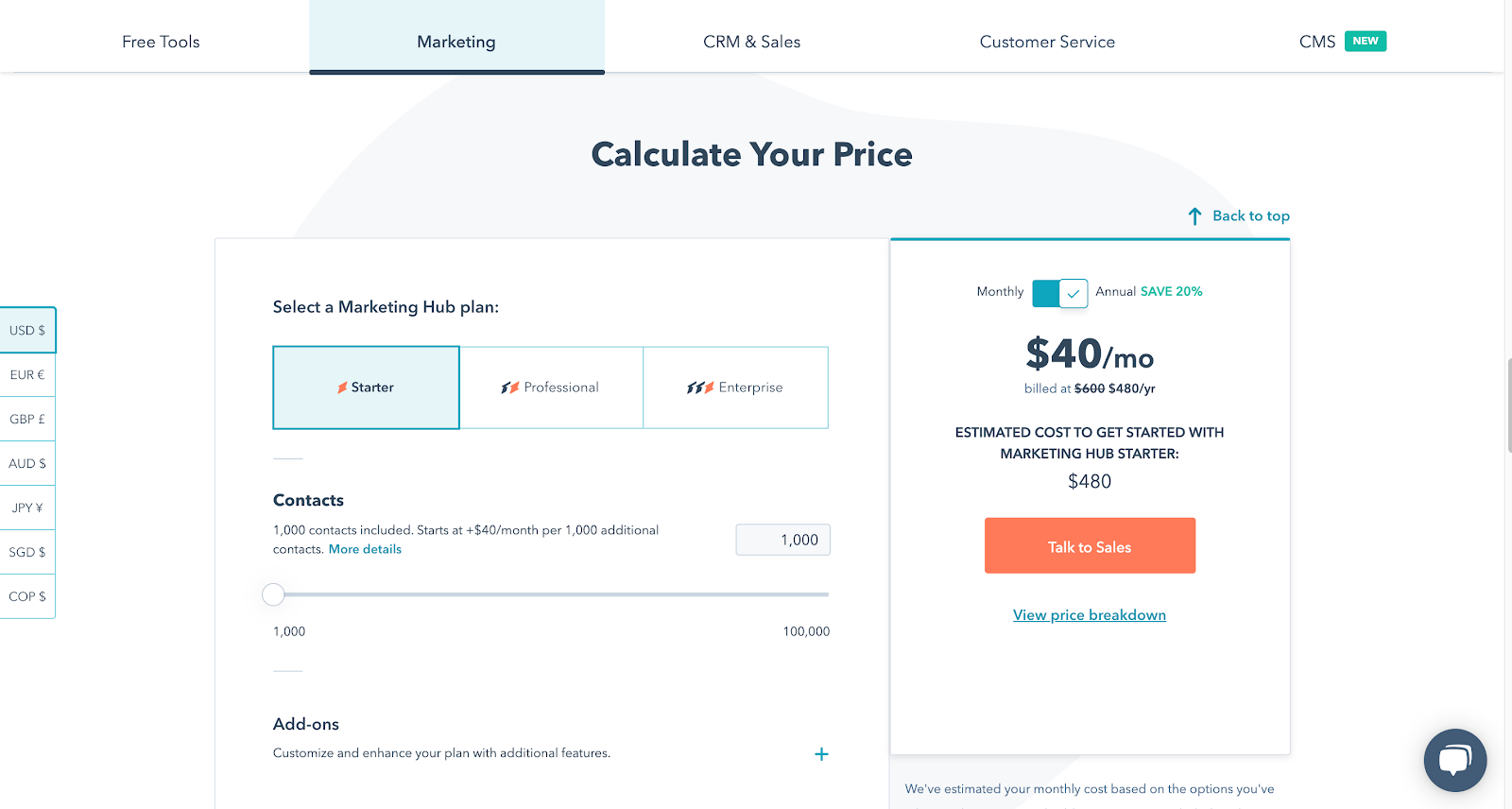

That doesn’t mean seats cannot be a good value metric — it is exactly that for Slack. But let’s look at another SaaS unicorn — HubSpot.

They don’t charge per seat, but rather per contact — because they know that companies who import and work thousands of contacts in their CRM are a) getting much more value from HubSpot and b) probably able to afford a higher price point.

Using “per seat” pricing, in this case, would risk leaving a lot of value on the table. Imagine a small team building a product with a lot of inherent virality. The business might be using HubSpot’s product to reach thousands of customers and generating revenue from them, but they’d be charging only for the 2-3 seats/people who are using the software.

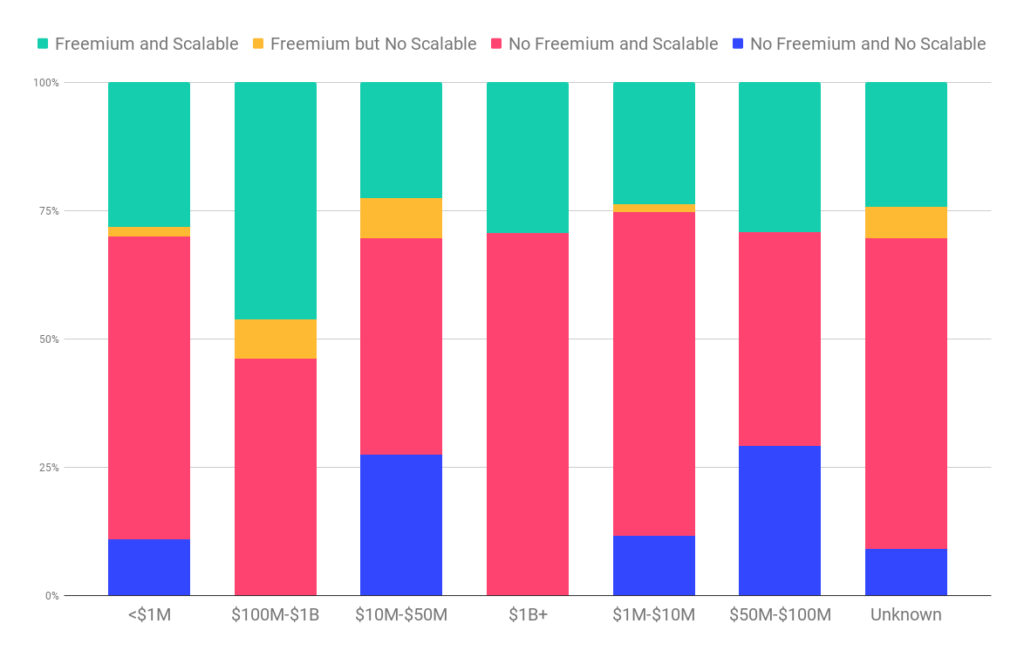

Value pricing is highly correlated to success in SaaS, so it’s not surprising to see that almost all the companies with annual revenue in the $100m+ bracket employ it:

While we’re on the topic of pricing, it would be interesting to also explore the companies that take advantage of product-led growth and value-based pricing in conjunction — we’ll do this in the next section.

Deep insight: The relation between product-led growth and value metrics

We talked about the importance of product-led growth and how some of the biggest SaaS companies use free plans to grow their user base and fuel their growth loops.

Value metrics allow the most successful software startups to achieve infinite scalability and net negative churn.

If both statements are true, then it should be pretty obvious when you compare vs. the revenue these companies have achieved. And it is:

There are no companies in the $100m+ bracket that don’t use either of these 2 strategies. And for those, looking to get to $1B in annual revenue, offering a free plan in conjunction with scalable pricing is a great way to add the extra bit of growth that can help them reach the next level.

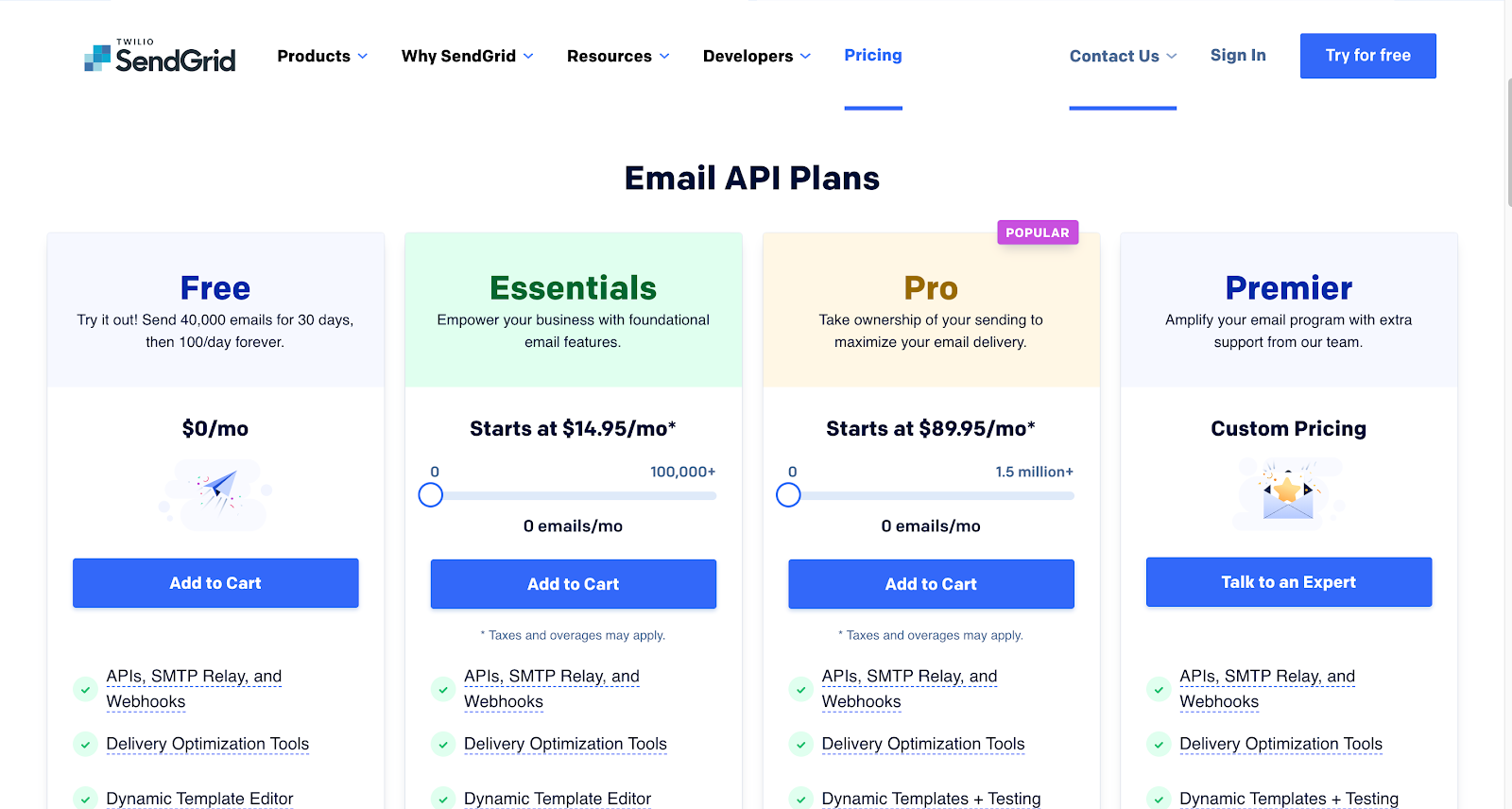

For example, let’s look at SendGrid, which automates the whole process around creating and sending emails — marketing, transactional, and so on.

SendGrid is a great fit for companies that send a lot of emails, but they target the full spectrum of companies — from 1-person startups to enterprise giants. And their pricing matches that focus.

When we look at SendGrid’s pricing, it is immediately obvious that their users experience value with each email they send.

SendGrid offers a free forever plan on which customers can send up to 100 emails each day. However, they also combine their trial into that, allowing new users to send up to 40,000 emails in their first month (coincidentally this is also the first pricing step in their Essentials plan).

As startups grow, they need to send more emails — more customers mean more sales receipts, account confirmations, newsletter messages, promotional campaign emails, and so on.

A customer who’s embedded SendGrid in their workflow early in their existence isn’t likely to actively go out and look for an alternative solution — especially if they can enjoy fair pricing, which charges them just for the right amount of features and email credits they need. SendGrid’s pricing is a great example of an aligned monetization strategy — they have managed to create a structure that supports their growth strategy.

Add-ons

Add-ons are a lot less common than we expected — less than a third of SaaS companies still use them as an element of their pricing.

That’s probably the best evidence of how limited their potential is to help SaaS companies grow — especially when we compare how popular scalable pricing is.

The only verticals in our dataset in which add-ons are popular are sales and project management software. Let’s look at an example to understand why.

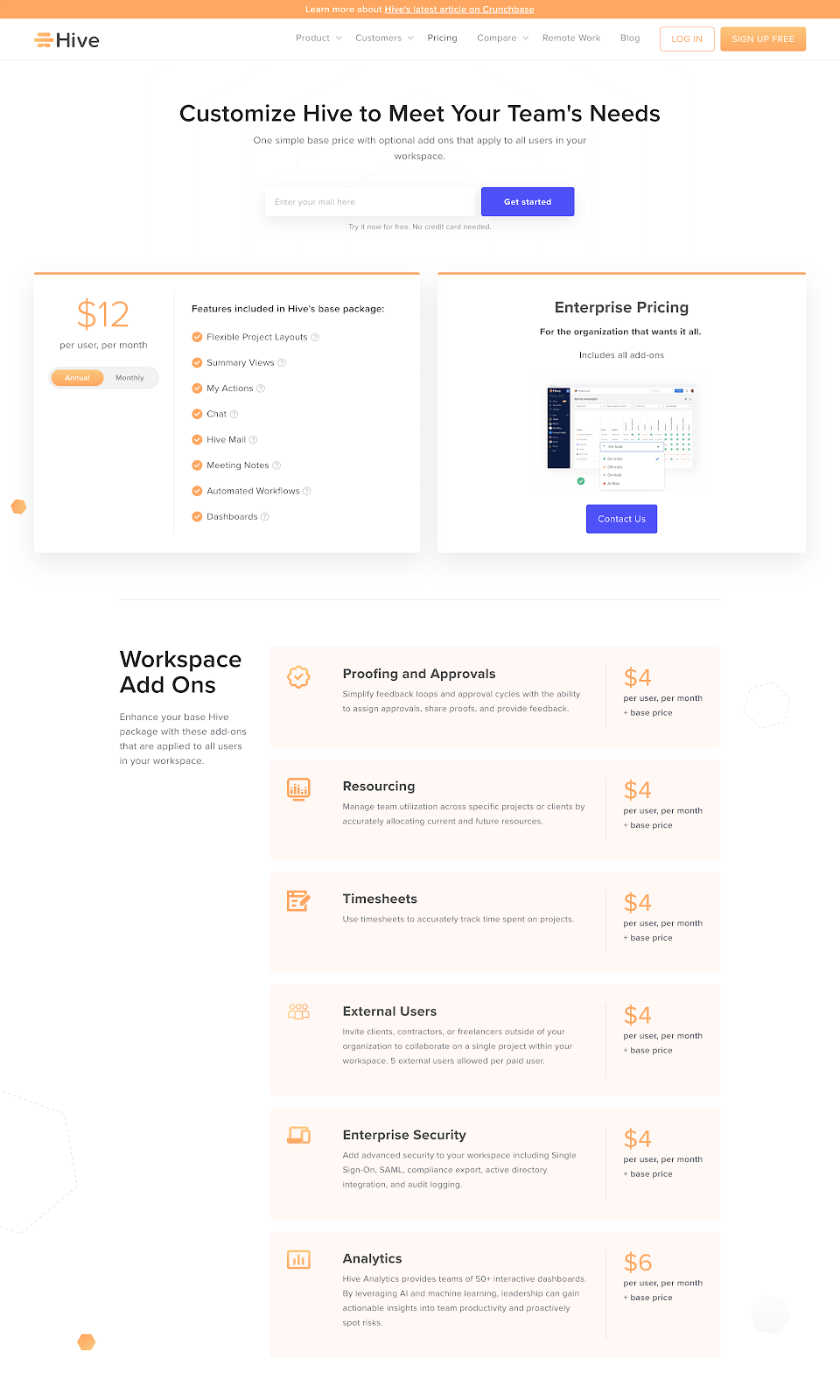

Case in point: Hive

Teams that use project management tools like Hive hold people in various roles — managers allocate resources and analyze performance, individual contributors track progress and the time they spend on projects, and so on.

That’s why these companies need to provide a flexible method of pricing, where each company using the product, can customize it (and what it’s paying) to its needs.

Hive is a smart example of how add-ons can be combined with scalable pricing to offer flexibility to your customers while maximizing your revenue.

Additional information and support

We hope we’ve made it clear throughout this document that your pricing page is more than a price tag that you slap on your product.

In this section, we want to show you how B2B SaaS companies use their pricing pages to answer questions and build trust with potential customers.

The elements we look at in this section are familiar to everyone who’s ever visited a SaaS website:

- The features table

- The FAQ

- Social proof elements

- The chat widget

Let’s see how popular each of them is.

Features tables

At a glance, features tables look like an odd choice for software companies — they take up a lot of space and they are much easier for a machine to process than a human.

Yet, features tables remain a popular element in SaaS:

The enduring nature of the features table is grounded in the fact that it allows you to condense a large amount of information and present it on a page with limited space.

When that’s not enough, SaaS companies resort to another “trick” — the collapsed features table:

Although they are not as popular, collapsable features tables allow SaaS teams to present even more information and transparency to their users.

Frequently asked questions (FAQ)

If you think FAQs belong to the internet from the 1990s, you need to revisit your beliefs.

FAQs are as popular as they’ve ever been — and especially in SaaS, which sits at the forefront of many of the newest internet trends.

The popularity of the FAQ section is proof that it works — it is there to answer the biggest mental blocks your potential customers have and help them make the next step (which is usually to start a trial).

Social proof

Testimonials, quotes, tweets — social proof is even more popular than the FAQ section:

This is not surprising, provided social proof is one of the most effective methods of influencing others outlined by Robert Cialdini in his seminal work Influence: Science and Practice.

Chat widget

Chat widgets are a valuable tool in your arsenal that allows you to accomplish several different things:

- You can address any remaining obstacles to converting

- You can aggregate that data and find ways to improve your pricing page (by answering questions it’s currently leaving unanswered for example)

With the proliferation of chat tools (and the availability of free solutions as well), it can be surprising to see they are not more popular.

However, we have to keep in mind that chat requires having a live person on the other end, who can respond and chat with your customers — preferably in real time. Chatbots are one innovation that allows companies to scale the use of live chat widgets and get around the need to have someone available at all hours of the day.

Even if you can’t afford to have a customer service rep available 24/7, a chat widget might still be a good way to learn about the questions that remain unanswered on your pricing page.

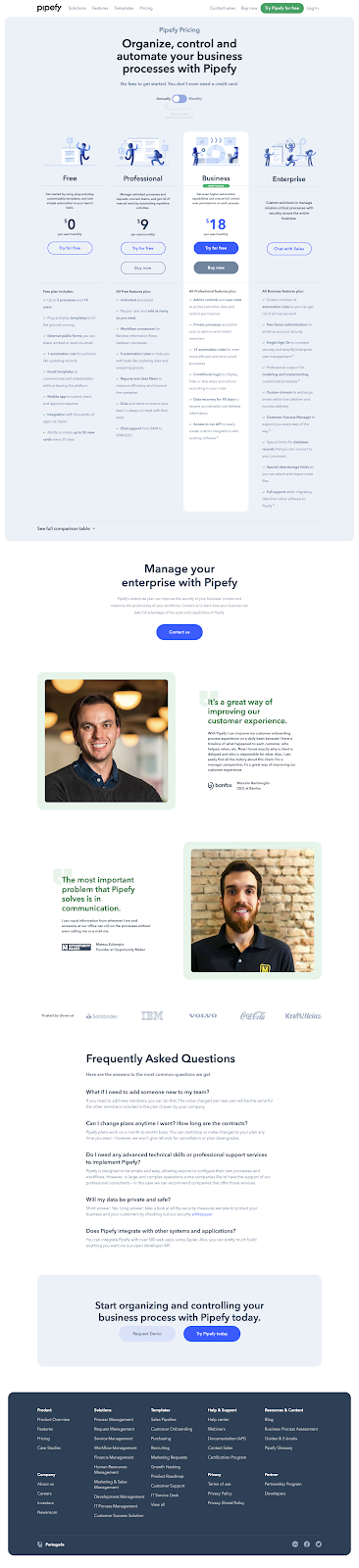

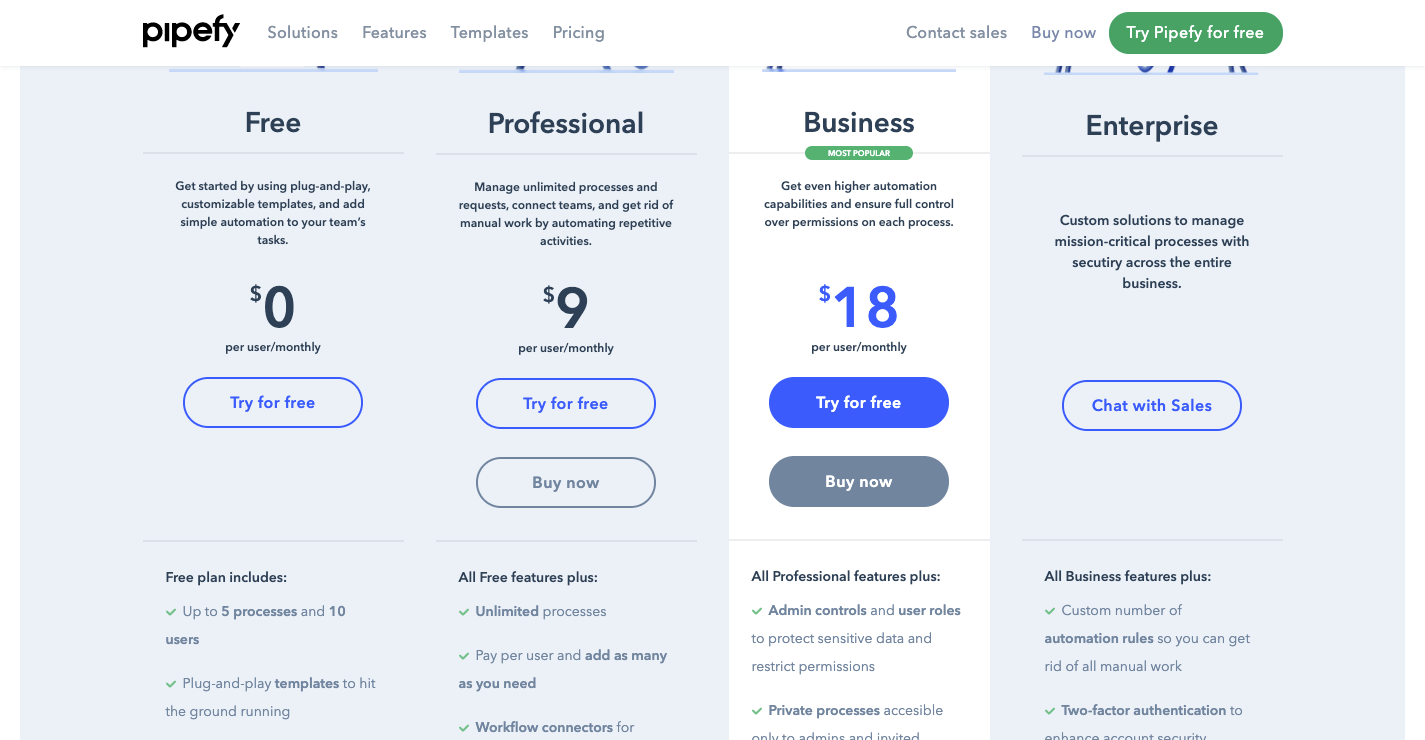

Case in point: Pipefy

Pipefy delivers a masterclass in how to use your pricing page to deliver value across the board.

Pipefy doesn’t waste any time or space on its pricing page. From the top of the page, the team shows you the plans you can get on, carefully outline the most profitable plan, and explain what you stand to win by subscribing to the annual plan (“Save up to 20%”).

The pricing table effortlessly turns into an explanation of the main features of each plan and there’s a toggle that allows viewers to see all features of all plans (along with explanations).

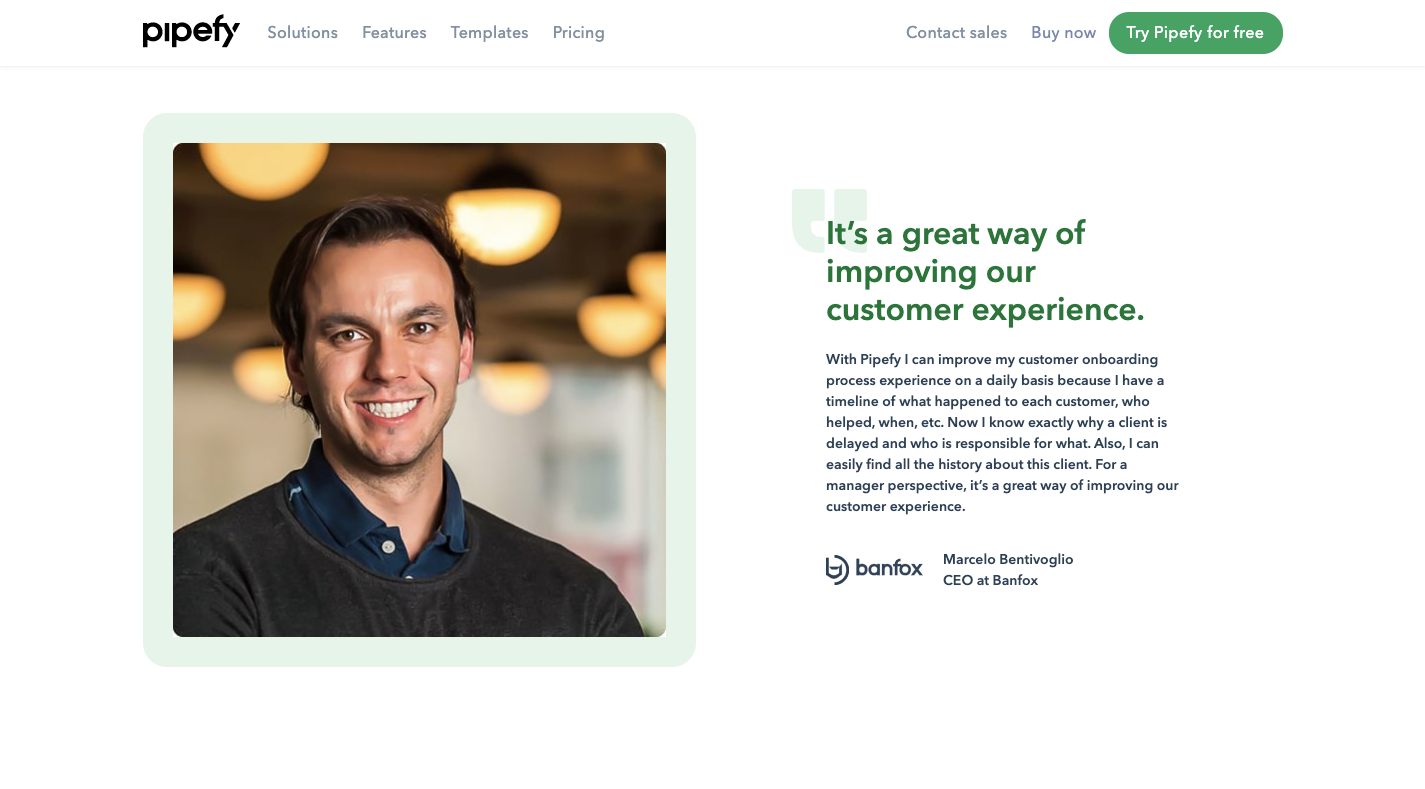

The text and information-heavy top section is followed by one dedicated to social proof. Pipefy is using a simple design that focuses the attention on the photo and the quote by their customers.

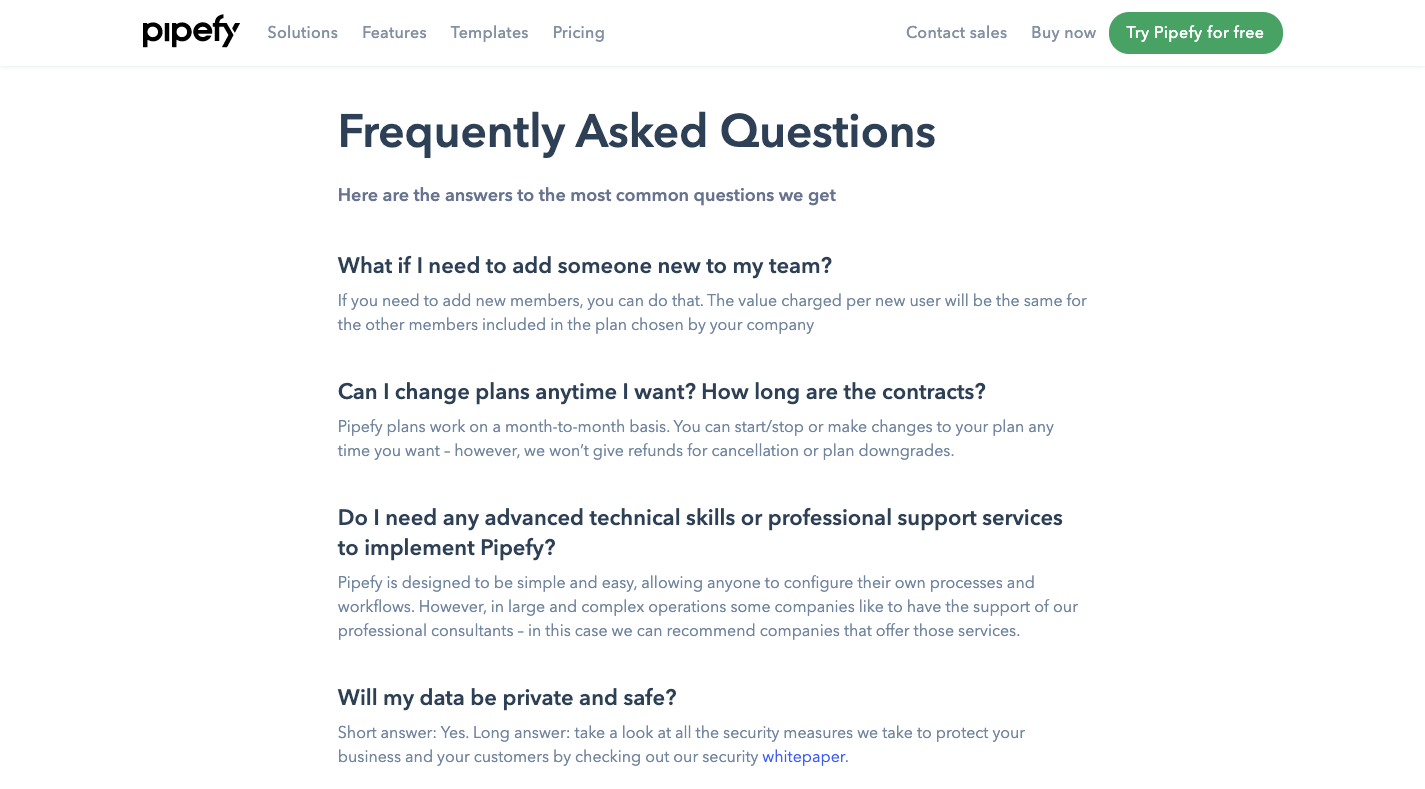

Finally, there’s a short FAQ section that answers the most high-level questions about using Pipefy.

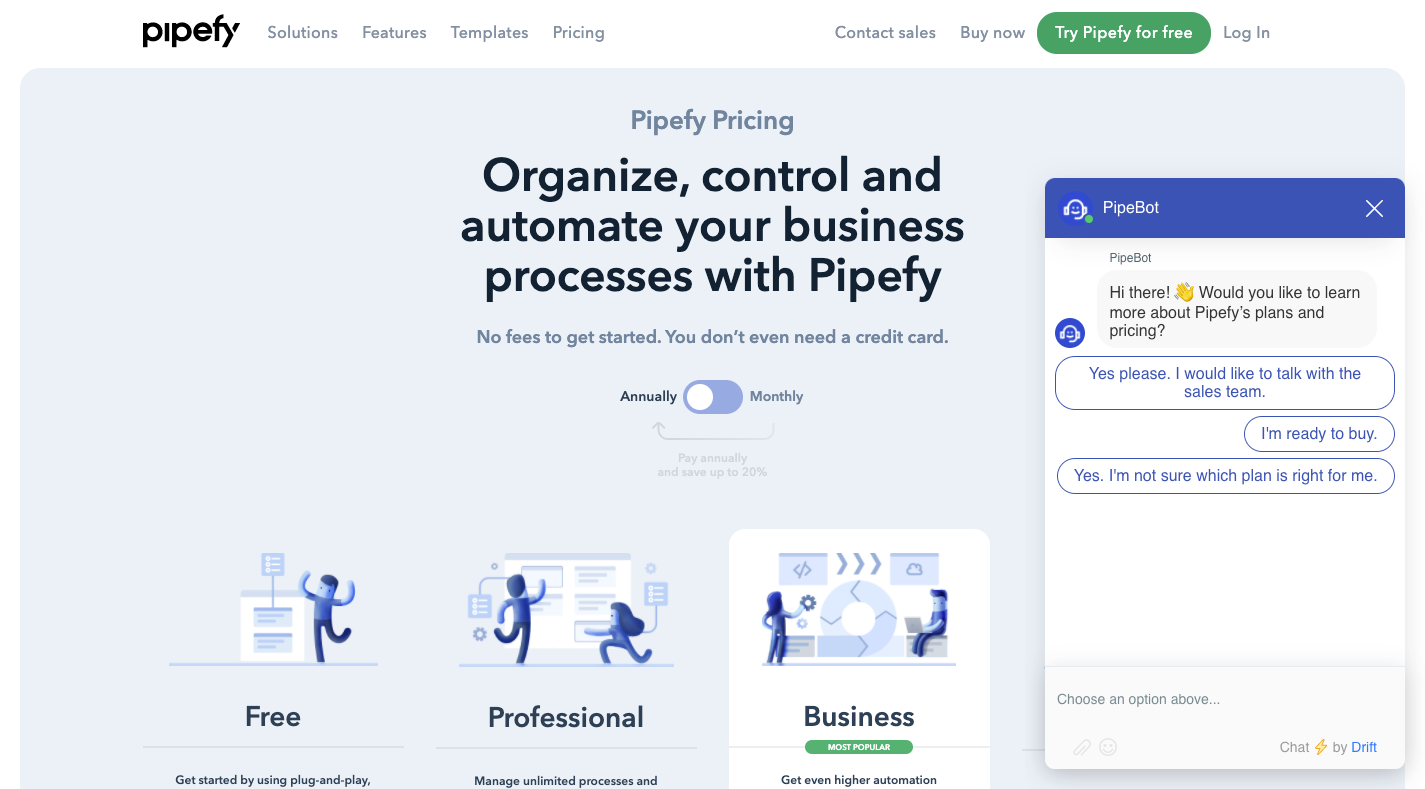

For all other questions, there’s a chat widget. Notice how Pipefy doesn’t leave people with a blank screen, but instead gives customers options to explore.

Conclusion: Your SaaS Pricing is Always a Work in Progress

Never “set and forget” it.

Always look for ways to improve your monetization strategy, your pricing, and your SaaS pricing page.

After all, you’re always working to improve the product and expand the audience you can offer it to — capturing adjacent users is the best tactic used by the most successful tech companies in the world to keep growing when they exhaust their initial audience.

Brian Balfour argues that successful models need to achieve the so-called “Four Fits” — an alignment between product, market, (business) model, and (distribution) channel(s).

If your product and your market are evolving, so should your monetization/business model.

In this report, we looked at the essential features of successful SaaS monetization through the lens of pricing pages. We believe this way we can understand what the teams who operate in this space believe in — not what they preach.

Here’s a summary of the most common features that occur in B2B pricing pages:

- Pricing is public unless for companies that target the enterprise where deals are much more customized the pricing is tailored to match.

- Most companies offer 3 or 4 tiers, with a custom tier aimed at capturing larger (enterprise) customers.

- The free trial is a standard; allowing customers to start one without entering a credit card is a good way to lower friction.

- SaaS companies understand the necessity of being flexible and offer customers the preferred way to pay — monthly or annually.

- A freemium model combined with scalable pricing is one of the most powerful tactics that can put a SaaS company on a unicorn trajectory. This allows you to capture customers early and grow along with them.

- Additional information served through elements such as a features table, an FAQ section, social proof, and a chat widget allows you to answer remaining questions and build trust.

We want to leave you with a final bit of advice before we part ways. We believe that learning from your customers is a lot more useful — so, never be afraid to continue experimenting with your monetization strategy, your pricing, and, of course, your SaaS pricing page.